- Federal Reserve hikes by 50 basis points (bps), current Fed Funds Rate at 4.25% – 4.50%. Amid a decelerating Consumer Price Index (CPI), the US Federal Reserve (Fed) broke a streak of 4 consecutive 75bps hikes to increase the Fed Funds Rate (FFR) by 50bps to a target range of 4.25%-4.50% in December. The 50bps quantum was unanimous and in line with the market consensus. However, we note that despite a smaller hike of 50bps, the hawkish narrative of the Fed remains intact as it foresees a higher terminal rate (at 5.00% – 5.25%) for the FFR with the expectation that there would be a potentially long pause before any rate cuts.

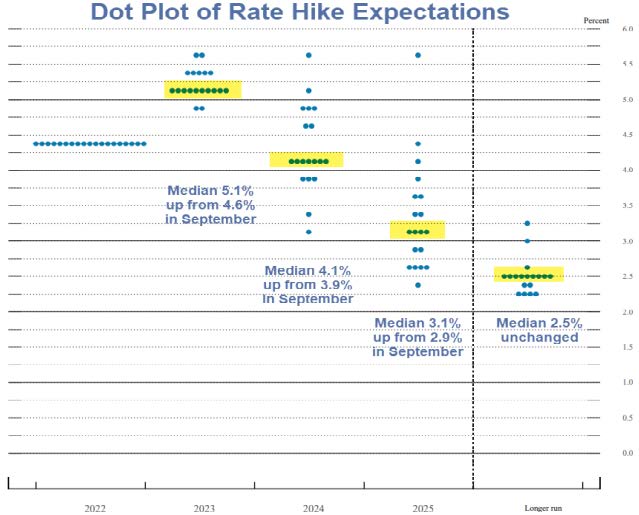

- Updated Fed dot plot reiterates hawkish narrative with higher terminal rate, leading to a possible divergence from market expectations. Key takeaways from the new dot plot are: a higher FFR by end-2023 at 5.00% – 5.25%, 50 bps higher than predicted by the FOMC in the September meeting (end-2023: 4.50%- 4.75%). Furthermore, there is little comfort looking ahead with a higher year-end rate expected for both 2024 and 2025 before the FFR settles at 2.5% in the long-run. The Fed’s terminal rate expectation has also diverged in relation to market expectations, with market participants pricing a lower terminal rate of 4.75% – 5.00% in 2023, perhaps as a result of decelerating CPI numbers (Oct’22: +7.7% YoY; Nov’22: +7.1% YoY). Moving forward, we do not discount the possibility of further volatility arising from the divergence in market and Fed views, as unfavourable CPI developments could become a catalyst for markets to reprice rate expectations upwards.

Figure 1: December Fed Dot Plot shows higher for longer Fed Fund rates.

Source: US Federal Reserve

- Fed economic projections turned gloomier; FOMC sees weaker US economic growth in 2023 despite labour market resilience. US Real Gross Domestic Product (GDP) growth for 2023 was revised significantly downwards to +0.5% YoY, compared to September’s projection of +1.2% YoY, consistent with Fed messaging of a “painful” rate hike path. The labour market on the other hand remained resilient heading into 2023, as non-farm payrolls repeatedly defied expectation of a slowdown in the job market. Solid wage growth coupled with real wages outpacing inflation in 2H22 (which could underpin consumer demand) is also a possible factor fuelling the Fed’s hawkish narrative despite slowing CPI in October and November.

- Malaysian yields were generally calm pre- and post-Fed rate hike, as 50bps hike was in line with expectation. The 50bps Fed rate hike notwithstanding, we still see Bank Negara Malaysia (BNM) positioning itself to hike the Overnight Policy Rate (OPR) to a terminal rate of 3.25% in 2023, given Malaysia’s steady growth in 2022 and elevated domestic inflation. Malaysian MGS yields were largely unfazed by the Fed decision, although we note the calm Malaysian bond market reaction was due to thinner year-end trading and the lack of other domestic catalysts following the appointment of Malaysia’s 10th Prime Minister. The rising risks of a slowdown in developed markets and a possible spike in geopolitical tensions could lead to a cap on bond yields from the Malaysian perspective heading into 2023.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.