OpusAsset

Specialist in Fixed Income Investment

OpusAsset is the brand name for the fund management business comprising Opus Asset Management Sdn Bhd (“OpusAM”) and Opus Islamic Asset Management Sdn Bhd (“OpusIAM”).

At OpusAsset, we are driven to help you preserve and grow your wealth by generating consistent risk-adjusted returns.

OpusAM and OpusIAM are regulated by the Securities Commission Malaysia. OpusAM is licensed to conduct fund management services and to deal in securities restricted in unit trusts. OpusIAM is licensed to conduct Islamic fund management services.

OpusAsset has a track record of more than 18 years in the fund management industry, we strive to be the fixed income specialist of choice.

As of 30 June 2024, OpusAsset manages a diverse range of portfolios, including four (4) unit trust funds, twenty (20) wholesale funds, and discretionary mandate portfolios with a total fund size of around RM8.4 billion. We are proud to offer a variety of investment options to our clients, including those that align with ESG (Environmental, Social, and Governance) principles, shariah-compliant funds, and conventional funds.

Our ESG portfolios are designed to provide socially responsible investment options for clients who prioritize sustainability and ethical practices in their investments. We carefully evaluate companies and investment opportunities based on ESG criteria to ensure that our clients’ investments align with their values.

Our shariah-compliant funds adhere to the principles of Islamic finance and offer investment options for clients who prefer to invest in accordance with shariah law. These funds are structured in compliance with shariah principles, such as avoiding investments in companies involved in prohibited activities such as gambling, alcohol, or tobacco.

Our conventional funds offer a range of investment opportunities across different asset classes and sectors, providing clients with a diverse range of investment options. Our experienced investment team carefully manages these portfolios to ensure that our clients’ investments are well-positioned to generate strong returns over the long-term.

At OpusAsset, we are proud to have a diverse client base, including some of the most well-known names in the insurance industry, intermediaries, federal/state government-linked companies & agencies, corporations, statutory bodies, foundations, co-operatives, hospitals, individuals and family trusts. We are honoured to have earned their trust and continued business.

Our Investment Objective

We aim to consistently outperform the benchmark through a disciplined investment process within the investment mandates and risk tolerance level of our clients.

Our Investment Philosophy

Long-term thinking

Our investments are driven by long-term views and secular trends, instead of merely reacting to short-term factors.

Fundamentals driven

We focus on credit-worthy, investment-grade issuers of debt, rather than frequent trading.

Market correlations matter

Correlations across global economies and asset classes set the framework for our asset allocation and maturity structure decisions.

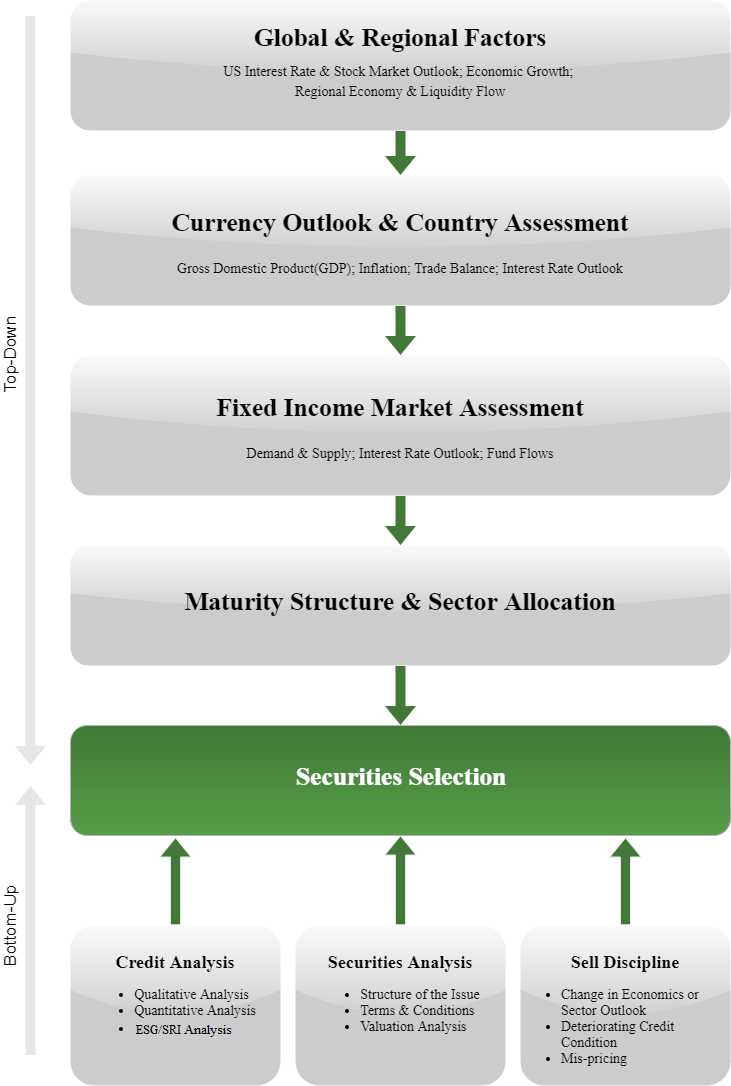

Our Investment Process

Top-down and bottom-up approach