11 June 2025

SUMMARY

➤ Malaysia will expand and revise its SST framework from 1 July 2025, keeping essential goods at 0% sales tax but imposing 5% to 10% on non-essential items, aiming to raise an extra RM5 billion in revenue.

➤ Service tax scope will broaden to cover rental/leasing, construction, fee-based financial services, private healthcare for non-citizens, private education, and beauty services at 6–8%, with selected exemptions and a compliance grace period until 31 December 2025.

➤ Inflation impact is expected to be minimal as essential goods remain exempt; BNM forecasts 2025 inflation at a range of 2.0-3.5%, supporting a neutral to slightly dovish monetary policy stance despite fiscal tightening.

➤ Bond yields remain stable amid strong foreign inflows; we continue to favour a tactical duration extension to 5–7 years, while selectively positioning in high-quality corporate bonds.

➤ Hence, we are maintaining our investment strategy of portfolio duration within 5 – 7 years with overweight exposure in high grade corporate bonds to minimize credit downgrade risk in slowing growth environment. We also look to enhance the returns of the portfolio through active trading in the secondary market.

- Malaysia will implement a significant expansion and revision of its Sales and Service Tax (SST) framework starting 1 July 2025, as part of the Budget 2025 fiscal reforms. The revised regime maintains a 0% sales tax on essential goods such as food staples, medicines, and basic construction materials, while introducing 5% to 10% sales tax rates on non-essential and discretionary goods to broaden the tax base and boost revenue. The government projects this move will generate an additional RM5 billion in SST collections, marking a substantial boost to fiscal revenues.

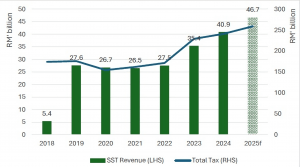

Chart 1: SST revenue contribution vs Total Tax Collection (2018 – 2024)

Source: Ministry of Malaysia

- The scope of the service tax has also been significantly broadened, with new categories such as rental or leasing (excluding residential property), construction (excluding residential buildings), fee-based financial services, private healthcare for non-citizens, private education, and beauty services now subject to rates between 6% to 8%. These changes are designed to close revenue gaps and bring more sectors of the economy under formal taxation, while selected exemptions are in place to avoid double taxation and ensure essential services for Malaysians are not taxed. To support businesses in adapting to the new requirements, the government has introduced a compliance grace period, with no penalties imposed for registration and reporting delays until 31 December 2025. Against regional peers, Malaysia’s indirect tax revenue remains structurally lower, with SST contributing less than 2.5% of GDP compared to 4–5% in countries like Thailand and Vietnam which suggests significant headroom for policy enhancement.

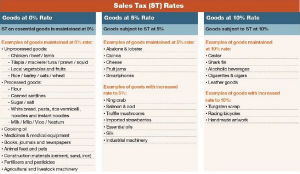

Chart 2: Implementation of Sales Tax Rates on selected items

Source: The Edge

- We expect the inflationary impact from the SST expansion to be minimal, given its highly targeted approach and the exclusion of essential goods and services from higher tax rates. Bank Negara Malaysia (BNM) estimates also suggest that even with the SST expansion the upside to consumer price inflation in 2025 will be modest, especially as GDP growth moderates and external uncertainties persist. With inflation forecast to remain manageable at 2.0 – 3.5% for 2025, the SST is not expected to pose a hurdle to monetary policy easing and the overall effect on consumer prices should remained contained.

NEUTRAL MONETARY POLICY STANCE FROM BNM DESPITE FISCAL TIGHTENING

- While fiscal measures may add upward pressure to prices, Bank Negara Malaysia (BNM) is likely to retain a cautious approach in the near term. With GDP growth easing to 4.4% YoY in 1Q2025 (4Q2024: 4.8% YoY) and inflation still within manageable bounds, the central bank has policy space to support domestic demand. We maintain our base case for a 25-bps cut in 2H2025, with possible execution in either July or September MPC meeting, as BNM seeks to balance fiscal tightening with external headwinds and subdues consumer spending. Timing of the move will hinge on inflation pass-through from SST, RON-95 subsidy rationalisation and global monetary conditions.

BOND MARKET OUTLOOK AND OPUS VIEW

- Despite global uncertainties, Malaysian Government Securities (MGS) yields remained stable. The 10Y MGS benchmark closed lower early June at 3.57% (-14 bps MoM) as foreign appetite for Malaysian bonds surged sharply, with net foreign inflows reaching RM13.4 billion in May’25 (4 years high) after significant jump in inflows from RM10.2 billion in Apr’25. This robust demand was led primarily by MGS, which accounted for nearly 90% of total bond inflows, while foreign holdings of Malaysian debt rose to RM229.3 billion, lifting the share of total outstanding debt to 35.6% (a 21-month high). The surge in inflows was driven by a global rotation out of U.S assets and Malaysia’s macroeconomic resilience and stable OPR at 3.0%. However, the expiration of the 90 days pause in reciprocal tariffs and US debt ceiling extension are two key global events to watch out which will have significant effects on capital flows and currency outlook.

- Nevertheless, we still aim to tactically lengthen duration to between 5 – 7 years, while focusing on high quality corporate bond to mitigate downgrade risk. We also look to trade opportunistically in the secondary market to enhance the portfolio overall returns.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.