18 June 2025

SUMMARY

➤ Israel launched surprise airstrikes on Iranian military, nuclear and energy sites on 12 June citing Iran’s proximity to developing nuclear weapons as an imminent threat.

➤ Global oil prices climbed to a five-month high as concerns over oil supply disruptions grew. However, no confirmed impact on the oil production or regional exports despite reports of Iranian oil and gas infrastructure being targeted. Similarly, traditional safe-haven currencies also strengthened.

➤ Nevertheless, Malaysia’s position as an oil and gas exporters could benefit from the higher global oil prices, provides a cushion against potential inflationary risks. Domestic bond market is expected to remain resilient given the internal economic resilience.

➤ Hence, we are maintaining our investment strategy of a portfolio duration within 5 – 7 years with overweight exposure in high grade corporate bonds to minimize credit downgrade risk in slowing growth environment. We also look to enhance returns of the portfolio through active trading in the secondary market.

- Israel launched surprise airstrikes on Iranian military, nuclear and energy sites on 12 June, citing Iran’s proximity to developing nuclear weapons as an imminent threat. According to Prime Minister Benjamin Netanyahu, Iran had produced enough highly enriched uranium in recent years to build nine nuclear weapons and could assemble one in a very short time. He also stated that Israel would continue its operations “for as many days as it takes” to halt nuclear weapons development in Iran. In response, Iran reiterated that its nuclear program is intended solely for civilian purposes, including energy generation and scientific research.

Table 1: Overall development on Israel-Iran conflict since 12 June

| 12 June 2025 (Thursday) |

|

| 13 June 2025 (Friday) |

|

| 14 June 2025 (Saturday) |

|

| 15 June 2025 (Sunday) |

|

- No signs of de-escalation in the Iran-Israel conflict as both sides intensify their military actions. The situation remains volatile mainly due to the sudden cancellation of Washington’s latest nuclear deal talks with Iran and President Trump’s historically tough posture against Tehran in his first term. Additionally, the escalating Middle East conflict adds even greater uncertainty to an already unpredictable G7 Summit as US President Trump returns after a seven-year hiatus. Nevertheless, the unforeseen conflict is expected to dominate the agenda, in addition to the initial focus on Russia’s war in Ukraine and US tariff disputes.

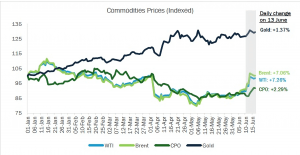

GLOBAL OIL MARKET

- Concerns over oil supply disruptions grew, pushing global oil prices to a five-month high. On Friday, the West Texas Intermediate (WTI) and Brent crude oil jumped nearly 7%, reflecting growing fears that the spread of conflict could spill over into the oil market. Elevated global oil prices usually carry a renewed risk of inflationary pressures. Inevitably, it may force major central banks to reassess their upcoming monetary policy decisions while trade uncertainties persist.

- However, there has been no confirmed impact on production or regional exports despite reports of Iranian oil and gas infrastructure being targeted. Nevertheless, investors are mostly monitoring the Iranian’s move as the country has threatened to disrupt shipping through the Strait of Hormuz—a vital chokepoint for approximately 20% of the world’s oil supply—should it face direct attack. Hence, the conflict could still pose risks to the global energy supply chain as it continues to escalate.

- Meanwhile, the Organisation of the Petroleum Exporting Countries and its allies (OPEC+) sees no need for unnecessary measures in the oil market and reaffirmed that the condition remained stable. The statement followed the International Energy Agency’s (IEA) observation that the situation might necessitate utilizing the emergency oil reserves, which currently hold over 1.2 billion barrels.

Chart 1: Commodities Price (Indexed) in 2025

Data as of 17 June 2025.

Source: Bloomberg. Data

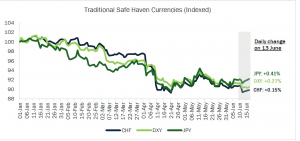

CURRENCY

- Traditional safe-haven currencies strengthened, led by the Japanese Yen (JPY) which gained +0.41%. The US Dollar Index (DXY) and Swiss-Franc (CHF) also rose 0.27% and 0.15% respectively. Notably, a smaller gain in the DXY compared to the JPY suggests that the US Dollar may be less appealing to investors due to the ongoing economic and trade uncertainties.

Chart 2: Traditional Safe Haven (Indexed) in 2025

Data as of 17 June 2025.

Source: Bloomberg

BOND MARKET OUTLOOK AND OPUS VIEW

- The prospect of the Middle East conflict remains a risk to the global oil market and inflationary pressures, as reflected in the bond markets movements. The US 10-year Treasury benchmark yield rose 0.37% or 1.3 bps to 3.548 while the MSG 10-year benchmark yield edged higher by 0.91% or 3.95 bps to 4.3987 on last Friday. Unless the situation escalates further or directly impacts the global oil supply chain, the disruption is expected to be temporary and market fundamentals are likely to reassert themselves in the medium term. Additionally, the global oil market is projected to remain relatively stable, supported by the agreed supply increase from OPEC+, moderate demand amid a slowing global economy, and the availability of emergency reserves.

- On the domestic front, Malaysia’s position as an oil and gas exporter provides a natural buffer against rising oil prices. From January to April 2025, crude petroleum and condensate imports made up 3.77% of Malaysia’s total imports, while only 42% of the local oil consumption is met through imports. As such, we see a minimal impact from the rising oil prices on domestic inflation, as the higher cost of imports is expected to be balanced by gains from exports. Additionally, inflation is poised to remain moderate on the back of Malaysia’s resilient economy, driven by robust consumer spending, an improving labor market, and proactive government policies.

- Looking ahead, a reallocation of funds from riskier assets to safe-haven instruments is expected to be underpinned by a risk-off sentiment. Overall, Malaysian bond market is expected to remain steady, with foreign inflows continuing to support the trading volume on the back of macroeconomic fundamentals, stable monetary policy and positive economic reforms.

- With a duration range of 5 – 7 years, we aim to focus on high quality corporate bond to mitigate downgrade risk. We also look to trade opportunistically in the secondary market to enhance the portfolio overall returns.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.