18 September 2025

Federal Open Market Committee (FOMC)

SUMMARY

➤ The US Federal Reserve (Fed) cut its key interest rate by 25bps to the range of 4.00 – 4.25% to support a softening labor market despite inflation remains elevated. UST yield curve shifted upwards by 4-7bps across while the dollar index closed higher by 0.25% on the widely anticipated cut.

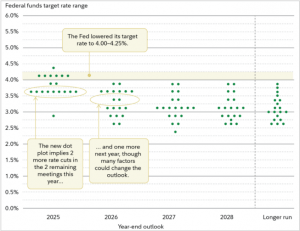

➤ The new dot plot showed two more rate cuts in the two remaining meetings this year to the range of 3.5- 3.75%. One rate cut for 2026 was also implied, however divergence in views amongst committee reflects persisting uncertainties.

➤ The looming US government shutdown is likely to drive UST yield curve volatility in near term should Congress failed to pass the stopgap funding measures on 1 October 2025 with unemployment rate likely to inch higher as public services being furloughed.

➤ We view monetary easing cycle in the US would be up to 50bps cut in total for the rest of 2025, being data dependent on evolving jobs and inflationary pressures. We expect the UST yield curve may gradually steepen as short-term yields decline while persistent tariff inflationary uncertainties and fiscal deficits kept long-end yields elevated.

➤ The local bond market in near term is expected to remain favourable supported by narrower interest rate differential and to hedge against volatility. Therefore, we target a duration strategy of between 5 – 7 years while focusing on high quality corporate bonds.

- The US Federal Reserve (Fed) cut its key interest rate by 25bps to the range of 4.00 – 4.25%, with Fed Chair Powell called it a risk management measure. The decision came after an 11-1 vote to lower interest rate by a quarter percentage point, with only newly-minted Trump appointee Governor Miran advocating for a half-point cut. Following the announcement, the UST yield curve shifted upwards by 4-7bps across, while the dollar index (DXY) closed higher by 0.25% to 96.87.

Chart 1: September 2025 Fed’s dot plot

Source: Fidelity

- The new dot plot also indicates that most of the FOMC members now anticipate two further cuts this year with a total of three cuts, compared to the previous dot plot of a total two cuts only. This would bring the benchmark to a range of 3.75-4.0%. Meanwhile, most FOMC members are expecting one rate cut in 2026, falling short of market expectations for three. The forecasts also revealed a wide divergence of views, with two voting members seeing as many as four cuts while three officials penciling in three rate reductions, reflecting uncertainties in the economy.

- Fed Chair Powell also added that the committee is done with large rate cuts (or hikes) of more than 25 bps for the period with current policy condition and pace of adjustments appropriate. He acknowledged the labor market are in ‘low hiring – low firing’ environment and any layoffs will not be replenished due to headcounts freeze that gradually feed into higher unemployment rate which he attributed to slowdown in immigration. Additionally, he also highlighted growing risks to the labor market, with job creation now below the level needed to keep unemployment steady in his speech.

- On the economic front, the committee again described economic activity as having “moderated” but added language saying that “job gains have slowed” and noted that inflation “has moved up and remains somewhat elevated.” Against the backdrop, the Fed’s dual mandate to balance employment and price stability could be challenged by both tariff-led and lower-rate-induced inflationary pressures. Nevertheless, the Fed maintained its 2025 core PCE and unemployment forecast at 3.1% and 4.5% respectively, while upgrading GDP growth forecast to an annualized pace of 1.6% (June projection: 1.4%) before reaching 1.8% growth in 2026.

- The independence of Federal Reserve was also closely monitored by all in this FOMC meeting. The dot plot featured one notably lower forecast pointing toward 1.25 percentage points cut, which most analysts attributed to Governor Miran, who had been sworn in just two days prior to the meeting. President Trump’s attempt to remove Governor Cook over alleged false statements in her mortgage agreements has heightened concerns about the Federal Reserve’s independence.

- In near term, we expect the impending government shutdown likely to increase UST yield volatility as deadline looms on 1st October 2025 with Congress poised to enter into a stalemate on stopgap measure to continue funding government agencies. The longest shutdown lasted 35 days (22 Dec 2018 – 25 Jan 2019) when first term President Trump bulldoze for funding expansion on border control.

Opus View

- We view the monetary easing cycle in the US would be continuing in subsequent meetings in 2025 with the Fed reverting being data dependent. We forecasted an additional 50 bps of rate cuts by year-end (25 bps in Oct & Dec meeting) from the Fed to support employment despite potential inflationary pressures which are still evolving. Job numbers are likely to play a more critical role in reframing policy easing decisions this year as next year’s rate path trajectory could be complicated by uncertainty in tariff-driven inflation as it becomes more evident by year-end and into 2026. We also expect the UST yield curve may gradually steepen with long term yields rise on concerns over inflationary risks and fiscal deficits while short term yields decline on rate cut expectations.

- On the domestic front, the local bond market is expected well-anchored in the near term supported by narrower interest rate differential as US starts its monetary easing cycle. We also opine that the domestic bond market remains as safe haven for investors seeking to hedge against potential volatility in the equity market in 2025. We continue to see a limited risk-reward benefit from longer-end duration, as the yield curve remained relatively flat predicted that the market is pricing another rate cut in 1H26 to which we would overweight duration strategy. Hence, we target a duration strategy of between 5 – 7 years, while focusing on high quality corporate bonds for yield pick-up and strategic trading opportunities to enhance returns from a relatively flat yield curve environment.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.