10 October 2025

SUMMARY

➤ The US federal government headed to a shutdown as Democrats reject the Republican-led stopgap bill extending funding through November 21. Democrats are pushing to include health-care provisions in the stopgap bill, such as extending Affordable Care Act premium subsidies, calling for a rollback of Medicaid cuts from Trump’s One Big Beautiful Bill Act and the restoration of public media funding.

➤ The government shutdown could temporarily lay off 750,000 federal employees, delay key economic data, and hinder monetary policy decisions. A partial shutdown could also cut weekly growth by 0.1–0.2 percentage points, while a full-quarter shutdown could lower 4Q2025 GDP by 1.2–2.4 points.

➤ US Treasury yield curve is expected to continue to shift upwards to risk-off sentiment. We also expect the two additional interest rate cuts expectations for the remainder of 2025 to remain intact but could be steeper and up to a total of 75bps.

➤ For Malaysia, the local bond market is expected to remain broadly stable after Budget 2026 announcement. However, local yields may be pressured upwards as local investors are rotating into corporate bonds amid rising pipeline issuances and paring down their government bonds. The absence of dovish monetary policy could reduce the appeal of local bond market.

➤ We widen duration strategy to a target range of 4.5–7 years (previously: 5-7 years) to allow room for profittaking and reposition to enter at higher yield level given the recent sell-down, with an overweight position in high-grade corporate bonds, trading at a reasonable yield, as part of strategy to balance risks and returns.

- With the new fiscal year starting on 1 October, the US federal government headed to a shutdown due to a stalemate in Congress over funding legislation. Republicans, who control both chambers, are pushing a stopgap bill to extend current funding through 21 November, daring Democrats to reject it. The bill narrowly passed the House but failed in the Senate, falling short of the required 60 votes with only 53 in favor, which led to President Trump closer to presiding over another government shutdown.

- Historically, there have been 14 government shutdowns since 1980. The most prolonged occurred in late 2018 during President Trump’s first term, lasting five weeks due to disputes over funding for the US-Mexico border wall. While shutdowns have typically had limited impact on markets and the economy, this time could be different. A recent memo from the White House’s Office of Management and Budget (OMB) instructed agencies

to prepare not only for temporary furloughs but also for potential permanent layoffs.

CONGRESS STANDOFFS

- Although Democrats hold limited power in Washington, their support remains critical to overcoming the Senate filibuster. Democrats are pushing to include health-care provisions in the stopgap bill, such as extending Affordable Care Act premium subsidies set to expire at year-end. These subsidies help lower insurance costs for many enrollees. They are also calling for a rollback of Medicaid cuts from Trump’s One Big Beautiful Bill Act and the restoration of public media funding eliminated in the rescissions package.

WHAT COMES AFTER A GOVERNMENT SHUTDOWN & RISKIER IMPACT

- The White House has warned of permanent mass layoffs in the event of a government shutdown, adding to the roughly 300,000 workers already let go earlier this year. If implemented, this would mark a break from precedent with shutdowns have historically led to temporary furloughs, not permanent job losses. For example, during the full shutdown in 2013, about 850,000 federal employees were furloughed, according to the Committee for a Responsible Federal Budget.

- The key federal agencies responsible for indicators of US economic activity, including the Bureau of Labor Statistics, Bureau of Economic Analysis and Census Bureau, will suspend economic data collection during a shutdown, resuming only when funding is restored. This disruption risks delaying critical indicators and

degrading data quality, potentially impairing the Federal Reserve’s ability to make informed monetary policy decisions. - Many federal services could be paused as non-essential agencies shut down operations. Essential functions such as Social Security, Medicare, military duties, immigration enforcement, and air traffic control would continue, but other services may face delays or disruptions. While the immediate economic impact may be limited, a prolonged shutdown could slow growth, unsettle markets, and erode public trust.

- In prior shutdowns, it is estimated that economic growth declined by 0.1-0.2% for each week of disruption with much of that activity made up in the follow quarter. However, this time round, the damage of the US shutdown could be deeper depending on the length:-

- First, some government agencies dodged the 2018-2019 shutdown because they’d received funding in advance and could just continue operating. This time round, there would be temporary layoffs of 750,000

federal employee with total daily compensation cost would be circa USD 400 mil with Trump has threatening mass firings; - Oxford Economics forecasted that a partial shutdown could reduce economic growth by 0.1 – 0.2 percentage points per week while a shutdown that lasts the entire quarter would reduce 4Q2025 real GDP growth by 1.2 – 2.4 percentage points; and

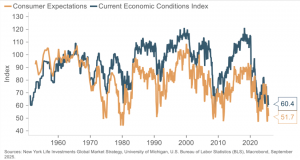

- A long-lasting shutdown may weigh on consumer sentiment as per the University of Michigan Survey, the 35- days 2018 – 2019 shutdown coincided with a 7% hit to confidence. With confidence already near historically depressed levels, this episode could have more pronounced effect than usual.

- First, some government agencies dodged the 2018-2019 shutdown because they’d received funding in advance and could just continue operating. This time round, there would be temporary layoffs of 750,000

Chart 1: US consumer sentiment near historic lows.

IMPACT ON MALAYSIA’S ECONOMY

- A government shutdown in the US could have modest negative impacts on the Malaysia’s trade performance. As market uncertainty rises and the outlook becomes less clear, businesses that depend on US economic indicators for forecasting may face greater difficulty in making informed trade and investment decisions. This would reduce demand from Malaysian exports, particularly in sectors with high exposure to the US market and those producing end-use goods (e.g. furniture, rubber gloves, apparels and textiles).

- On the broader economy, we remain optimistic about Malaysia’s outlook, supported by domestic demand, stable political environment, healthy fiscal trajectory. We believe Budget 2026 to remain supportive in navigating ongoing external challenges. The budget is likely to bolster domestic consumption, target export-oriented and high-value sectors, enhance wage growth, and reinforce the government’s commitment to structural reforms and fiscal consolidation. We continue to expect the Q3 and Q4 GDP to fall between 4.0-4.5% for 2025.

CAPITAL MARKET OUTLOOK & OPUS BOND MARKET VIEWS

- We expect the US Treasuries benchmark curve to continue to shift upwards as market remains cautious over the economic and political stability of the US. We also expect the two additional interest rate cuts expectations for the remainder of 2025 to remain intact; however, we see the US Federal Reserve may opt for a steeper rate cut of up to a total 75bps if the mass layoff materialized and softening labour market intensified further from a current base level to cushion the economy.

- Gold spot has hit historical highs of USD 4,042 per ounce with MYR depreciated by 0.23% to 4.2170 per USD from 4.2070 since the start of the US government shutdown. The FBMKLCI index rallied to 1,638.09 before settling down to 1,629.67 as market turned cautious head of Budget 2026 and Sabah state election following October 6 state assembly dissolution.

- The MGS yield curve shifted up by 4 – 7 bps across benchmark tenors as foreign outflows continued after non-resident investors pulled out RM6.8 bn from Malaysia debt market last month, the largest outflows since October 2024. This pronounced selloff in the debt market offset mild foreign inflows into Malaysian equities market in September (RM 0.1 bn vs -RM 3.4 bn in August). Going forward, capital flows are expected to remain volatile and uncertain, reflecting divergent growth trajectories across regions and sectors.

- Domestically, we see the local bond market remain broadly stable after the Budget 2026 announcement. However, local yields continued to be pressured upwards as local investors are rotating into corporate bonds which offers higher all-in-yields amid rising pipeline issuances and paring down their government bond exposures to provide the liquidity needed. Additionally, the absence of dovish monetary policy could reduce the appeal relative to other emerging markets with easing cycles. We also anticipate Ringgit to remain steady, supported by foreign fund inflow amid appreciating US dollar due to higher gold demand.

- The domestic fixed income market proved to be a reliable asset class to shield investors from volatility, with support from narrower interest rate differentials and local investors. We widen duration strategy to a target range of 4.5–7 years (previously: 5-7 years) to allow room for profit-taking and reposition to enter at higher yield level given the recent sell-down, with an overweight position in high-grade corporate bonds, trading at a reasonable yield, as part of strategy to balance risks and returns.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.