18 October 2025

SUMMARY

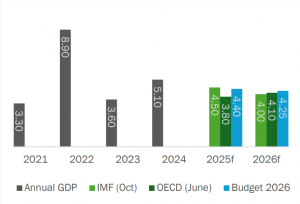

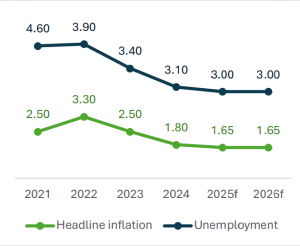

➤ Budget 2026 forecasted Malaysia’s GDP growth at 4.0–4.8% in 2025 (IMF: 4.5%; OECD: 4.3%) and 4.0– 4.5% in 2026 (IMF:4.0%; OECD; 3.9%), aligning with medium-term targets. Inflation is expected to stay mild at 1.3–2.0%, and unemployment holding at 3.0%. Total revenue is projected at RM343.1b while the expenditure including off-budget contribution is estimated at RM470b.

➤ Malaysia’s fiscal deficit is projected to narrow to RM76.7 billion in 2025 (3.8% of GDP) and RM74.6 billion in 2026 (3.5%), reflecting continued fiscal consolidation. Total bond issuance for 2025 is guided at RM170.5 billion and we expect higher gross issuance for 2026 due to larger volume of maturing bond. Net supply should continue to moderate.

➤ Into 2026, Malaysian bond markets may find support from growing corporate issuance, lower net supply, stable economic and political environment, and lower global rate environment with downside pressures from volatile capital flows and elevated global risks.

➤ We widen duration strategy to a target range of 4.5–7 years (previously: 5-7 years) to allow room for profittaking and portfolio rebalancing to take advantage of recent profit-taking activities, with an overweight position in high-grade corporate bonds, trading at a reasonable yield, as part of our strategy to balance risks and returns.

- Budget 2026, the first under the 13th Malaysia Plan, sets a cautious foundation for inclusive and sustainable growth amid global uncertainties. Guided by the Madani principles, it focuses on raising national growth ceiling, uplifting living standards floor and bolstering reforms for good governance and institutional integrity.

- It continues Malaysia’s path of fiscal consolidation, with a narrowed deficit and restrained spending, but offers little in terms of upside surprises or bold new growth drivers. The absence of surprises is unsurprising, as the government prioritizes stability over ambition, which could leave investors and businesses looking for stronger signals of reform or expansion disappointed.

ECONOMIC PROJECTION

Figure 1: Full year GDP growth (%)

Source: Ministry of Finance

Figure 2: Unemployment and headline inflation (%)

Source: Ministry of Finance

- The GDP growth forecast for 2025 has been revised in Budget 2026 to a more cautious range of 4.0% to 4.8% (Budget 2025: 4.5-5.5%), reflecting adjustments due to evolving global and domestic economic conditions. Meanwhile, real GDP growth estimated at 4.0- 4.5% for the full year 2026, aligning with the 13th Malaysia Plan’s medium-term target of 4.5% to 5.5% annually through 2030.

- Headline inflation is forecasted to remain benign at 1.3% to 2.0%, aided by subsidy targeting and stable global commodity prices, while gross exports are expected to grow at 2.8% amid moderating trade tensions. unemployment is projected to hold at 3.0%.

- The IMF maintained its forecast real GDP growth for Malaysia at 4.5% in 2025 and 4.0% in 2026 for Malaysia in its October World Economic Outlook Update, consistent with its April’s projection. Similarly, the OECD projected growth at 3.8% for 2025 and 4.10% for 2026 in its Juneforecast. While both institutions acknowledged that the tariff impact was less severe than forecasted, the risks remained tilted to the downside, stemming from higher trade barriers, renewed concerns over fiscal risks, inflationary pressures and financial market repricing.

- Based on MoF projections, the imposition of tariff is estimated to reduce Malaysia’s real GDP by 0.38 ppt in 2025 mostly from indirect impact given the country’s trade with the rest of the world accounts for more than 80% of Malaysia’s total trade. The impact of tariff is anticipated to be felt in 2026 as it will reflect a full year effect as compared with the five-month (August – December) effect in 2025 with projected growth to be lower by 0.76 ppt in 2026.

Figure 3: Impact of US Tariff on Malaysia’s GDP, Exports and Imports

Source: Ministry of Finance, Malaysia (estimates)

FISCAL REVENUE

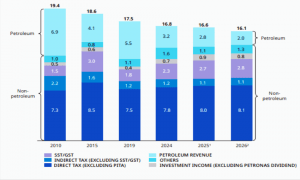

Figure 4: Federal Government Revenue (% of GDP)

Source: Ministry of Finance

- Revenue in 2025 is estimated to grow by 2.9% to RM334.1 billion, lower than the initial projection of RM339.7 billion. The lower revenue estimation was mainly dragged down by weaker corporate income tax and lower petroleum income tax. As for 2026, total revenue is projected at RM343.1 billion, a 2.7% increase, driven by a mix of tax and non-tax sources:

- Direct taxes are projected at RM187.4 billion, an increase of 5.8%, driven by company income tax at RM103.4 billion and individual income tax at RM49.1 billion.

- Indirect taxes are expected to reach RM83 billion, up 8.9%, mainly supported by Sales and Service Tax (SST) collections amounting to RM59.6 billion.

- Non-tax revenue is forecast to decline by 9.9% to RM72.7 billion, primarily due to a lower dividend contribution from Petronas, estimated at RM20 billion.

- Malaysia fiscal revenue-to-GDP ratio is expected to dip again in 2026 to 16.1% from 17.3% in 2023 largely driven by weaker non-tax revenues notably lower dividends from Petronas. The budget expects slight increase in tax revenue-to-GDP in 2026, to 12.7% of GDP from 12.6% in 2025, despite higher duties on cigarettes and alcohol, and plans for a new carbon tax, as well as the full-year effects of e-invoicing and expanded Sales and Service Tax that were implemented in 2025.

- The shift to e-invoicing is projected to raise RM80–90 bn, aiming to capture an estimated 30% shadow economy (circa RM600 bn of GDP) which is currently undeclared. This is a high-yield effort but it does raises concerns about “squeezing” economic activity by raising the cost of doing business.

- Despite absence of new tax measures, the key focus of Budget 2026 is to enhance tax administration and plugging compliance gaps through digital tax stamps, levying ceiling price of RM 300,000 in tax exemptions for vehicles purchased in duty-free islands and expanding tax on profit distributions received by partners in limited liability partnership (LLP).

FISCAL EXPENDITURE

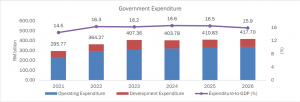

Figure 5: Government expenditure

Source: Ministry of Finance

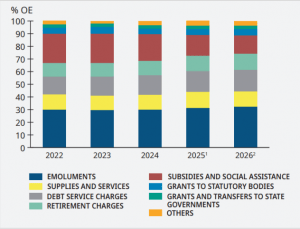

Figure 6: Operating expenditure by category (%)

Source: Ministry of Finance

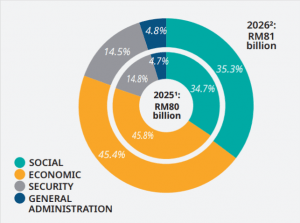

Figure 7: Development expenditure by sector (%)

Source: Ministry of Finance

- Total expenditure for 2025 is estimated at RM412.1 billion, 2% lower than the previously budgeted RM421 billion. For 2026, the core federal expenditure is projected at RM419.2 billion (2% higher than the 2025 estimation; 0.4% lower than the 2025 initial budget). When off-budget contributions are included, the total public spending envelope rises to RM470 billion which comprises of: –

- Operating expenditure (OE) is projected at RM338.2 billion, increasing by 1% (2025: RM332.2 billion) due to higher emoluments on implementation of Phase 2 of the Public Service Remuneration

System (SSPA), as well as the supplies and services and debt service charges. - Development expenditure (DE) is forecasted at RM81 billion, 1.3% higher than RM80 billion in 2025. The allocation by sector has reduced for economic sector, particularly in the agriculture and rural development subsector, while expanded for all other sectors.

- Off-budget contributions total RM50.8 million, including RM30 billion from government-linked investment companies (GLICs), RM10 billion from public-private partnerships (PPPs), and RM10.8 billion from statutory bodies and Ministry of Finance entities.

- Operating expenditure (OE) is projected at RM338.2 billion, increasing by 1% (2025: RM332.2 billion) due to higher emoluments on implementation of Phase 2 of the Public Service Remuneration

- Debt service charges which represented the third-largest component of OE is expected to increase by 7.6% reaching RM 54.3 bn or 16.3% of GDP in 2025 and projected to rise to 17.2% or RM 58.3bn with the bulk is allocated for domestic interest and profit payments while the remaining for offshore borrowings. However the annual growth rate for debt service charges has been slowing, decreasing from 12.3% in 2023, 9% in 2024 and 7.6% in 2025 but still far from the targeted 15% set under the Fiscal Responsibility Act.

FISCAL CONSOLIDATION

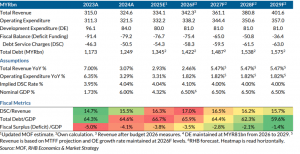

- For 2025, the fiscal deficit is estimated at RM76.7 billion, down from the initial forecast of RM80 billion, while the debt-to-GDP maintains 3.8% of GDP. For 2026, fiscal deficit is projected to be lower at RM74.6 billion or 3.5% of GDP, reflecting a commitment to fiscal consolidation while maintaining debt at 64.7% of GDP, below the 65% statutory ceiling. The MOF has guided a total bond issuance of RM170.5 billion for 2025, comprising RM 82.5 billion for MGS and RM88.0bn for GII.

- Overall, Malaysia is moving towards the direction of a favorable debt metrices with which ratings improvements could potentially be within a few years horizon should current fiscal trajectory of revenue growth outpacing expenditures resulting in debt-to-GDP trending below 60% and debt-service-ratio-to-GDP improving towards 13% in line with similar single A ratings peer group. Presently Malaysia’s sovereign ratings is rated A3/A- by Moodys and S&P ratings while Fitch placed a BBB+ ratings after downgrading it from A- in 2020.

Schedule 1: Fiscal forecast or 2026 to 2029

BOND MARKET OUTLOOK AND OPUS VIEW

- We project the overnight policy rate (OPR) to remain steady in 2025 should GDP growth comes in within official forecast of 4 – 4.8%. Given the lagged effects of tariffs due to ground-building administration and enforcements and the subsequent potential direct and indirect impact, we anticipate BNM to cut OPR further by another 25 bps in 2026 on risk management basis should growth slipped under 4.0% (official projection: 4 – 4.5%).

- Gross issuance in 2026 is expected to rise, driven by notably higher refinancing needs for MGS+GII maturities amounting to RM108.7 billion (2025: RM83.5 billion). We forecast a higher gross MGS+GII supply of RM180- 188 billion but a lower net supply of RM75-79 billion (2025F: RM87 billion). Into 2026, Malaysian bond markets may find support from growing corporate issuance, lower net supply, stable economic and political environment, and lower global rate environment with downside pressures from volatile capital flows and elevated global risks.

- The local benchmark yield curve is expected to remain relatively stable in the near-to-medium term, underpinned by macroeconomic stability and strong support from local investors amid ongoing global uncertainties that fuel market volatility and demand for safe-haven assets. Domestic local benchmark curve will be anchored by the absence of dovish monetary policy and narrower interest rate differentials as US has begun its monetary easing cycle (two rate cuts expected in Q42025).

- Nevertheless, the benchmark curve could face moderate upward pressures from increasing corporate issuance in Q4 2025. We expect corporate issuance to increase further (6M2025: RM94.23bn 2024: RM124.15bn; 2023: RM118.3bn) given most issuances are backloaded thereby putting pressure on the MGS yield curve as investors make pivots from government bonds to make room for new corporate issuances. We expect highquality corporate bonds to outperform amid demand push from investors’ rotating out from lower-yielding instruments to higher-yielding bonds. The long of the yield curve could face modest upward pressure due to increased corporate bond supply and persistent global risk sentiment.

- We widen duration strategy to a target range of 4.5–7 years (previously: 5-7 years) to allow room for profit-taking and portfolio rebalancing to take advantage of recent profit-taking activities, with an overweight position in highgrade corporate bonds, trading at a reasonable yield, as part of our strategy to balance risks and returns.

| Sector/Industry | Budget Highlights |

|---|---|

| Industrial & Manufacturing |

|

| Export-oriented sectors |

|

| SMEs & Corporate Investments |

|

| Capital Markets |

|

| Technology & Innovation |

|

| Government & enforcement |

|

| Tourism |

|

| Infrastructure |

|

| Energy & Environment |

|

| Agriculture |

|

| Islamic economy & Halal industry |

|

| Social Protection & Healthcare |

|

| Property |

|

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.