Dr Ray Choy, Head of Economics & Research at Opus Asset Management.

Are we there yet?

The degree of economic uncertainty in 2022 will remain very high. Unlike cyclical downturns that are more predictable and in line with the common knowledge, the evolving situation on COVID is essentially force majeure and that makes the planning of policy responses extremely difficult. Countercyclical fiscal policies require not merely forward-looking plans, but sufficient economic buffers in terms of reserves, flexibility to raise debt, and economic resilience for them to work effectively while maintaining confidence in the economy. The management of contingent risks are effective insofar as the economic capacity for unforeseen circumstances is available and in this regard, government balance sheets around the world are stretched after battling the pandemic over the last two years. Nonetheless, policy creativity has allowed most governments to scrape the barrel for the necessary public spending programmes.

The spectre of COVID continues to loom over 2022. Developed nations have reported rising cases in recent weeks, while the threat of new virus mutations (e.g. Omicron) remain a risk. This has implications on the aforesaid ability of economic actors to plan spending programmes and implications on risk aversion by all stakeholders in any economy. This heightens the risk of hysteresis, whereby behaviour becomes enduringly changed, and in this situation, invariably cautious. In turn, this would lead to a depression in investment rates and raise the propensity for savings. Reinforcing this, corporate balance sheets and bank lending behaviour is showing both quantitative and anecdotal evidence of cash hoarding; this leads to strains on government budgets and by extension, the taxpayer, perpetuating a negative feedback loop.

Against this structural backdrop, the economy at the level of the business cycle should see a bounce going into 2022. While it is difficult to justify blue skies for the economy, the bar for a recovery has been set low. At the very least, growth in 2022 should recover from the low base in 2021. Furthermore, a more pragmatic approach to COVID risk management could be adopted as economies cannot afford to remain ensconced with the same draconian degree of mobility restrictions as seen in the past. Given the rise in COVID cases in Europe and the US, one could surmise diminished social and political will to backtrack on economic re-opening, highlighting the difficult compromise between health and wealth.

Room for emerging markets and risky assets to outperform

A major uncertainty to be faced by all asset classes in 2022 is the shift in global funds flows between markets of lower yields (i.e. lower returns and risks) and markets of higher yields (i.e. higher returns and risks) due to changing interest rate expectations. This creates considerable uncertainties when the direction of asset returns remain unpredictable. On the bond markets, rising inflation causes uncertainties in wealth preservation on already thin yields. The inflation increase in this case, is made more difficult to forecast since much of it is driven by commodity prices, which have historically been very volatile and beyond the control of economic policy. Volatility aside, COVID has caused supply chain disruptions and shortages in labour that leads to and higher costs being passed to consumers. Also, companies that have yet to be fully plugged into the digital economy are unable to reap the benefits of lower costs and higher productivity from enhanced technological capabilities. Nonetheless, we could draw comfort that falling commodity prices should lead to a decline in inflation, at least from cost-pushed reasons. This had been driven by an ongoing deflation of the property bubble in China, a greater shift towards environmentalism, and an easing of shipping costs as the initial boost from pent-up demand eases over time.

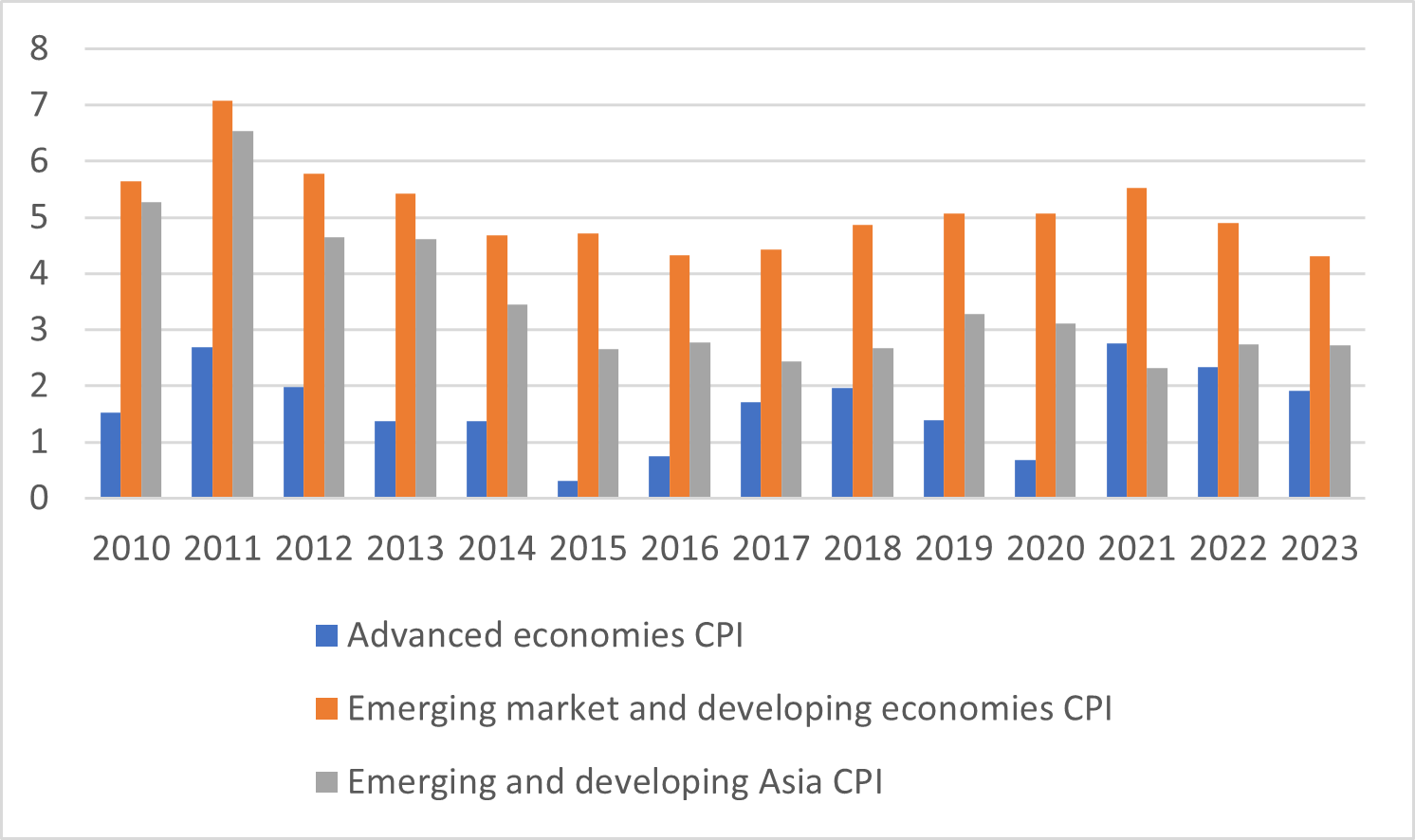

Consequently, the investment environment in 2022 is made particularly complex since the performance calculus emphasises inflation-adjusted returns, on top of risk-adjusted returns. Traditionally, emerging markets are seen as riskier than developed markets, as defined by development status and credit ratings. However, given the dominance of the inflation narrative in 2022, investors are likely to begin noticing that high and accelerating inflation is mainly situated in advanced economies, while developing economies are no stranger to high inflation. In fact, the long term inflation trend and volatility at emerging economies has declined, leading toward a convergence in inflation levels between developed and developing economies over time. Should this fact gain wider traction, the risk of fund outflows from emerging markets to developed markets could be ameliorated.

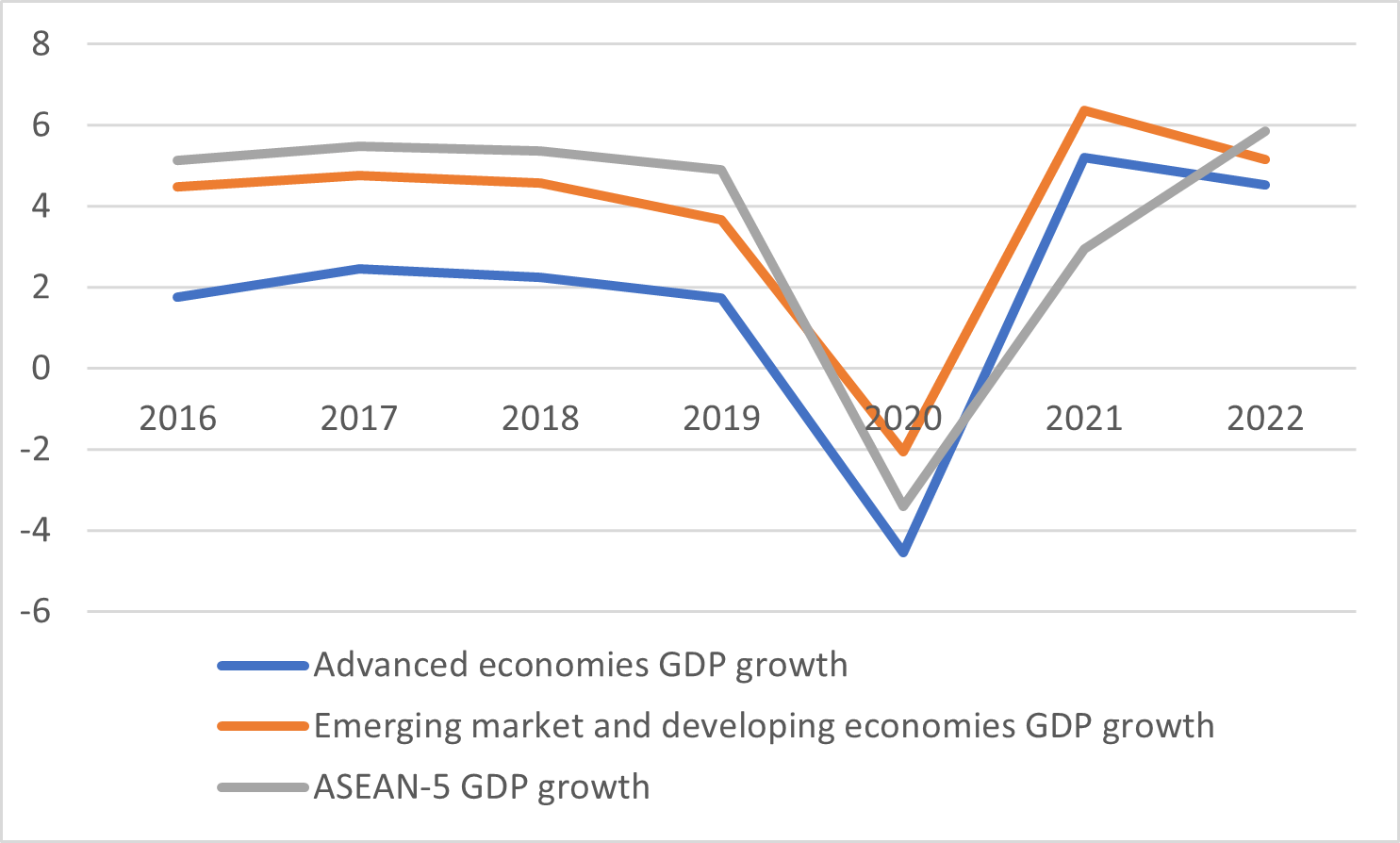

The concept of inflation-adjusted returns can be applied across several asset classes. For the equities market, higher return in growth equities are more likely to be pursued. This may seem counterintuitive when higher interest rates are expected since this is the base case in 2022. However, the economic recovery remains uncertain and central bankers around the world are more likely to pursue the path of least resistance especially when economies continue to suffer the aftereffects of the pandemic. Furthermore, 2022 will see several major elections in the US (the mid-term election on 8-Nov-2022), in Asia-Pacific (e.g. Australia, South Korea, Hong Kong, Philippines, Malaysia) and major European countries (e.g. France, Austria). Usually, a conducive political goes hand-in-hand with an accommodative economic policy backdrop that is supportive of riskier asset classes such as equities and emerging market currencies. This implies a brighter outlook for the adoption of more risk (e.g. increased investments into emerging markets), especially on economies which are not complicit to inflation mismanagement. By extension, this would support inflows to developing Asian economies and investment grade markets where fundamentals remain relatively healthy, namely Thailand, Indonesia, Malaysia and China.

Compromises lead to balanced markets

A seeming contradiction is that emerging market debt levels are stretched, although high fiscal deficits attributable to the pandemic will be temporary and markets are likely to look past the tail risks that have occurred over the last two years. The scrutiny by international investors and monitors such as rating agencies would likely contain government budgets to reasonable levels, since few countries would be willing to pursue unsustainable policies and risk a capital exodus. By and large, sovereign downgrades, should they occur, are unlikely to have a major impact on healthy risk appetite as the economy embarks on the recovery. Usually, inflation and credit risks start worrying markets when it approaches a significantly higher level, such as double digit inflation (common in some emerging economies) and a cross over from investment grade to high yield ratings. Furthermore, the rare fact that inflation today is higher in developed economies certainly helps create a more benign outlook for the developing nations.

While QE tapering and higher interest rates remain matters of concern, they are unlikely to change significantly in 2022, given the fragile economic recovery, populist politics given elections and lingering strains of the virus. All asset classes, be it equities, fixed income, commodities or investing regions stand to benefit from easy liquidity conditions. I remain doubtful that interest rates and monetary policy will return to a traditional cycle of ups and downs, since ageing populations, lower savings and investment rates, and productivity growth through technology leads to a propensity for structurally lower interest rates. This has been a recurrent theme for several decades and there is little to suggest otherwise. Even if interest rates were to rise in 2022, markets will be pricing in “what’s next”, only to be answered by the rattle of a rusty can being kicked down the road.

Over time, inflation has accelerated in the advanced economies but has gradually declined in developing economies

Source: IMF

GDP growth in 2022 will continue to recover, with ASEAN-5 being above trend

Source: IMF

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.