By Opus Asset Management Sdn Bhd

- Jerome Powell reaffirmed the Federal Reserve’s (Fed) hawkish stance towards rate hikes. Despite Consumer Price Index (CPI) (June: +9.1% YoY; July: +8.5% YoY) and Personal Consumption Expenditures (PCE) (June: +6.8% YoY; July +6.3% YoY) readings slowing YoY in July, Jerome Powell was adamant that the Fed would take “forceful and rapid steps” to continue taming inflation. Of note, the Fed chairman was willing to accept that its hawkish stance would trigger “a sustained period of below-trend growth”, although he stopped short of saying that the US was currently in a recession. The Fed Chairman was cognisant that historically, inflation-fighting policy could turn ineffective if policymakers faltered on rate hikes.

- Jackson Hole symposium reveals divide between Asian and Western perspectives on interest rate policy. We note that the heads from the Bank of Korea and Japan were quick to illustrate a different outlook for Asian economies. The larger role of cost-push inflation in Japan as well as the significant chance that Asia will be able to return to an environment of low inflation were highlighted, while China also responded by emphasizing the risks stemming from a ‘Nixon shock’ and the weaponization of the US Dollar. This suggests that central banks in Asia are unlikely to raise interest rates as aggressively as the US.

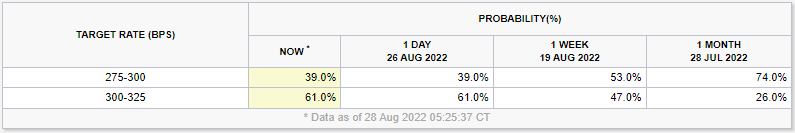

- Financial markets reacted sharply; expectations are for a September rate hike of 75bps. After the release of relatively dovish Fed meeting minutes back in July where Powell noted its current 2.25% Fed Funds Rate level was “neutral”, markets were blindsided by his hawkish comments at Jackson Hole. US equities reacted negatively with major indices deep in the red, while rates traders digested Powell’s comments by pricing in a higher than 50% chance of a 75bps hike in September. As seen in Figure 1, we note the sharp change in market expectations now, given that markets viewed a 50bps rate hike in September as more likely (74% chance).

Figure 1: Markets pivoted back to a 75bps September rate hike following Jackson Hole symposium.

Source: CME Group

- Malaysian bond market has already priced in more rate hikes. Despite lower inflation compared to the developed countries, the Malaysian bond market has currently priced in another 2-3 rate hikes, with the 3-Year MGS at ~3.35% as of writing. The Malaysian bond market saw some mild weakness in following Powell’s statements, but going forward, further interest rate hikes have the potential of slowing down growth and inflation which will support the bond market.

- Malaysian Overnight Policy Rate (OPR) seen to rise another 50bps from current 2.25% level. In view of Malaysia’s Gross Domestic Product (GDP) better-than-expected reading for 2Q22 (Actual: +8.9% YoY; Consensus: +7.0% YoY), we expect BNM to hike another 50 bps for the rest of the year, bringing the OPR to 2.75% by end-2022. Each of the 25bps rate hikes are expected to occur in the policy committee’s meetings in September and November. This is in line with our view whereby BNM will gradually normalise rates in tandem with the expected strong growth in Malaysia’s economy for the rest of 2022.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.