23 May 2025

SUMMARY

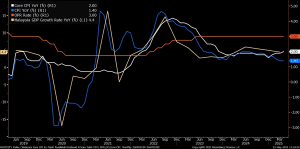

➤ Malaysia’s headline inflation remained steady at 1.4% YoY in April 2025, unchanged from March and marking the lowest level since November 2023. This was consistent with market expectations, despite core inflation rose to 2.0% YoY, the highest in 17 months, driven by higher costs in personal care, education, and housing-related components.

➤ We expect BNM to cut the Overnight Policy Rate (OPR) by 25 bps in 2H2025, likely either July or September MPC meetings. Stable inflation backdrop and soft GDP growth provide BNM with some flexibility to adopt a more accommodative stance, especially as downside risks from US tariffs, softer commodity prices and geopolitical trade tensions.

➤ Malaysian Government Securities (MGS) yields remained relatively stable, with net foreign inflows reaching RM10.2 billion in Apr’25 Foreign holdings of Malaysian debt rose to RM288.7 billion in April 2025, the highest in seven months.

➤ With stable yields and limited upside potential, we continue to favour a tactical duration extension to 5– 7 years, while selectively positioning in high-quality corporate bonds.

- Malaysia’s headline inflation held steady at 1.4% YoY in Apr’25, matching the pace seen in Mar’25, marking the lowest rate since November 2023. The stability was consistent with market expectations

and reflects subdued price pressures across the consumer basket. Despite benign headline figure, core inflation rose to 2.0% YoY in Apr’25, the highest level in 17 months, up from 1.9% YoY in Mar’25. The underlying components of index price increase were personal care, social protection and miscellaneous goods and services which surged by 4.1% (Mar’25: 3.6%), followed by education 2.3% (Mar’25: 2.2%) and housing, water, electricity, gas, and other fuels 2.0%, (Mar’25: 1.9%).

Chart 1: Malaysia’s Inflation & GDP vs OPR

Source: Bloomberg, DOSM

- Monthly topline inflation tipped higher by 0.1% MoM in April 20205 as compared to prior months underpinned by the same basket of components which drives YoY inflation.

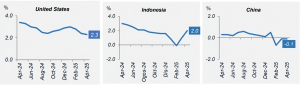

- Out of 573 items tracked, nearly 58% of the components registered price increases, while about a third recorded declines. Regionally against peers, Malaysia’s headline inflation rate remains lower than Vietnam (3.1% YoY) and Indonesia (2.0% YoY), but higher than Thailand (0.19% YoY) and China (-0.1% YoY). Looking ahead, inflation is expected to remain manageable, though risks from global commodity price volatility and the anticipated rationalisation of RON95 fuel subsidies could add to price pressures in the second half of the year. Bank Negara Malaysia (BNM) is expected to maintain a dovish stance with the possibility of rate cuts in coming.

Chart 2: Inflation for Selected Countries (April 2024 – 2025)

Source: DOSM

Bond Market Outlook

- We expect BNM to cut the Overnight Policy Rate (OPR) by 25 bps in 2H2025, with split probability in July or September Monetary Policy Committee meeting. The expectation is underpinned by Malaysia’s softer GDP growth of 4.4% YoY in the Q12025 (Consensus: 4.5% YoY) and headline inflation trended below its 12-month average, providing BNM latitude to adopt more accommodative stance in support of economic growth. The anticipated rate cut is aimed at cushioning external growth risks stemming from US imposed trade tariffs and heightened global trade uncertainties. While the timing of the cut will depend on further economic data and the outcome of ongoing trade negotiations, we shall see July meeting as a key window coinciding with the end of the US’ 90-day tariff pause, allowing BNM to assess the full impact of external shocks before acting.

- Despite global uncertainties, Malaysian Government Securities (MGS) yields remained stable. The 10Y MGS benchmark closed lower mid-May at 3.65% (-13 bps MoM) as foreign appetite for Malaysian bonds surged sharply, with net foreign inflows reaching RM10.2 billion in Apr’25 (21-month high) after

significant jump in inflows from RM3.2 billion in Mar’25. This robust demand was led primarily by MGS, which accounted for nearly 90% of total bond inflows, while foreign holdings of Malaysian debt rose to RM288.7 billion, lifting the share of total outstanding debt to 13.4% (a seven-month high). The surge in inflows was driven by a global rotation out of U.S assets and Malaysia’s macroeconomic resilience and stable OPR at 3.0%. - We aim to tactically lengthen duration to between 5 – 7 years, while focusing on high quality corporate bond to mitigate downgrade risk and for additional yield pick-up.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.