December 2025

SUMMARY

➤ The US Federal Reserve (Fed) cut interest rates by 25 basis points (bps) to 3.5-3.75% to move policy away from being overly restrictive, which should help stabilize the labor market. The UST yield curve moved downward, with UST 2Y falling 7 bps to 3.54%. Meanwhile, the dollar index (DXY) closed marginally lower by 0.2% to 98.59.

➤ Overall Fed’s tone shifted to cautious with Fed Chair Powell acknowledging risks to both sides of the dual mandate. Meanwhile, the dot plot now signals only one additional 25 bps rate cut in 2026, bringing the target range down to 3.25%–3.50%, alongside upward revisions to economic projections. Meanwhile, the Fed plans also to purchase US$40 billion in Treasury bills this month to maintain liquidity.

➤We update our base case view of a total 50 bps rate cut in 2026, although the timing and magnitude of each cut remained uncertain due to various complicating factors. Nevertheless, the UST benchmark curve is expected to remain volatile as market assess the overall economic and market developments.

➤ We expect Bank Negara Malaysia (BNM) to hold Overnight Policy Rate (OPR) steady at 2.75% until 1H2026. However, a rate cut is anticipated full-year GDP growth for 2026 decline below forecasted growth of 4% YoY. Domestic bond market is expected to remain stable with support from a broad-based resilient fundamental.

- The US Federal Reserve (Fed) cut Federal Funds Rate by 25 basis points, setting the new target range at 3.5- 3.75%. Since September 2025, the rate has eased 75 bps and 175 bps since last September 2024. Fed Chair Powell briefed that the quarter percentage rate cut was intended to pivot Fed’s current policy from restrictive level to a policy rate position that enable weakening labor market to stabilize amid soft service inflation. US Treasuries (UST) benchmark yield curve shifted lower, with UST 2Y falling 7 bps to 3.54% while UST 10Y slipped 4 bps to 4.15%. The dollar index (DXY) closed marginally lower by 0.2% to 98.59. Correspondingly, the USD/MYR exchange rate settled with stronger ringgit appreciating by 0.25% to 4.1077.

- The Fed’s shifted to a cautious tone describing growth as “expanding at a moderate pace” (revised from solid”) and highlighting “elevated uncertainty in the outlook. The statement and press conference emphasized “cooling in the labor market” and “risk of tariff inflation turned persistent” with Fed Chair Powell acknowledging “upside risks to both sides of Fed’s dual mandate”. This reflects growing wariness amid late-year data volatility due to federal shutdown, making the outlook feel less assured than in September.

- Dissent in views within Fed members persisted, despite 9 voted for a cut against 3 dissented. Chicago Fed President Austan Goolsbee and Kansas City Fed President Schmid dissented in favor of leaving rates unchanged, citing concerns that further easing could reignite inflationary pressures. Fed Governor Miran however, pushed for a more aggressive 50 bps cut, arguing it was necessary to more forcefully support employment amid rising downside risks to labor market. The fractured vote underscores the Fed’s internal tensions as it navigates competing pressures from inflation and job market weakness.

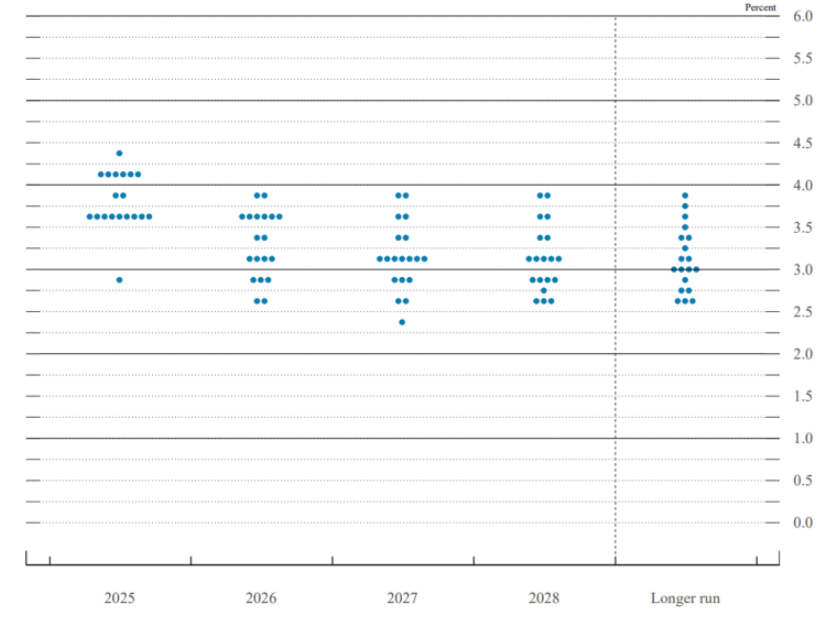

Chart 1: FOMC participants’ assessments of appropriate monetary policy on September 2025 meeting.

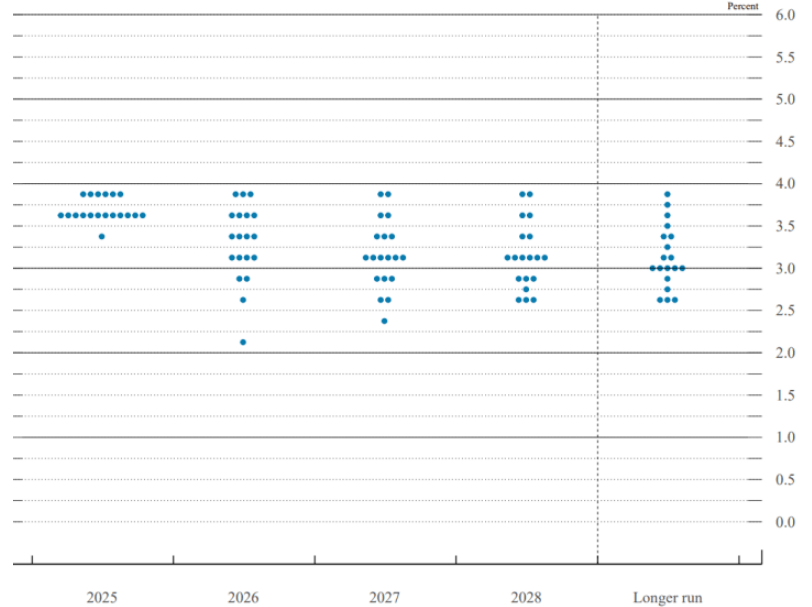

Chart 2: FOMC participants’ assessments of appropriate monetary policy on December 2025 meeting.

- Additionally, the dot plot now signals only one additional 25 bps rate cut in 2026, bringing the target range down to 3.25%–3.50% as the Fed officials refreshed their economic projection. For 2026, US economic growth is expected to accelerate to an above-trend 2.3% (previously: 1.8%), amid moderate 4.4% (previously: 4.4%) unemployment rate while inflation is projected to ease to approximately 2.4% (previously: 2.6%) by year-end. This forecast, though hindered by incomplete post-shutdown data, dispels mounting concerns regarding potential stagflation.

- The Fed also announced to purchase US$40 bn in Treasury bills beginning this month to manage market liquidity and maintain an ample supply of reserves before the April tax season that may shrink money supply later. The announcement was made to prevent similar occurrences in 2019 where money market rates were forcefully pushed higher beyond Fed Funds rate as liquidity supply shrunk and overnight borrowing rate skyrocketed squeezing corporates relying on short-term funding for working capital expenditures.

- Additionally, the rise of K-economy with higher-income earners seeing wealth creation rising while the lower income households struggling with weaker income gains and steep prices reflects widening inequality which could potentially result in spending pullback by the middle-to-lower income earners putting next year’s growth at risks amid higher perceived tariff-induced inflation .

Opus View

- We update our base case view of a total 50 bps rate cut in 2026, although the timing and magnitude of each cut remained uncertain due to various complicating factors e.g. higher risks to unemployment and inflation. With wider dispersion of views on near-term interest rate outlook, Fed’s reaction to the incoming data is becoming more difficult to anticipate. Coupled with Fed Chair Powell’s term ending in May, the nomination

process is expected to trigger a series of events thereby intensifying market volatility until the new Chair takes office at Fed’s June meeting. - The UST benchmark yield curve is expected to remain volatile in 2026 as markets adjust their expectations for rate cuts, driven by factors such as the Fed’s evolving stance, the appointment of a new Fed Chair, labor market conditions, and tariff-induced inflationary risks, and the deluge in Treasury issuances.

- On the domestic front, we expect Bank Negara Malaysia (BNM) to hold Overnight Policy Rate (OPR) steady at 2.75% until 1H2026 given Malaysia’s balanced growth profile and contained domestic inflation. Nevertheless, a rate cut cannot be ruled out should full-year GDP growth for 2026 decline below forecasted growth of 4% YoY (BNM’s target for 2026: 4.0% – 4.5%).

- Meanwhile, domestic bond market is expected to remain stable with support from stronger performance of the ringgit, a narrower interest rate differential with major economies, sustained demand from local institutional investors, and a lower net supply of bond issuance due to fiscal consolidation effort. Corporate bond issuance is also likely to remain robust, supported by a stable economic momentum and resilient outlook.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.