President Trump announces reciprocal tariffs

4 April 2025

- On 2 April, the Trump administration announced one of the largest tariff hikes in US history, imposing sweeping tariffs across all its trading partners. Tariffs will comprise of a baseline 10% tariff rate (effective 5 April) and targeted reciprocal tariffs on countries identified as having a very large trade deficit with the US (effective on 9 April). Under the new reciprocal tariff measures imports from Malaysia will face a 24% tariff. Other major Asian countries were also impacted such as China (34% on top of the current 20% implemented early January), Vietnam (46%), Taiwan (32%) and Japan (24%) among others.

Figure 1: Announced Reciprocal Tariffs (Source: White House)

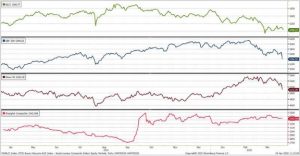

- The magnitude of tariff hike comes as a surprise which is expected to result in much higher inflation and a major slowdown in the global economy. Market participants reacted negatively after the announcement, resulting in a major sell-down in stocks, reflecting concerns on the impact of tariffs and uncertainties. The S&P 500 went back to correction territory on Thursday, declining 4.84%, while the Dow Jones and Nasdaq fell 3.98% and 5.97% respectively. The Kuala Lumpur Composite Index (KLCI) fared better, as investors digested the news, with the index lower marginally by 0.5%.

- The dollar ended weaker as traders fled to alternative safe-haven currencies such as the Japanese Yen and Swiss Francs. The USD/MYR closed lower at 4.426 on 03 April.

Figure 2: Equity market sell-off amid the risk-off environment (Source: Bloomberg)

- Among Malaysia’s export sectors, electrical and electronics (E&E) products are most vulnerable due to their heavy reliance on U.S. demand, representing about 7.9% of Malaysia’s total exports in 2024. Other affected industries include rubber products, furniture, and optical and scientific equipment, which collectively face heightened risks due to their high exposure to the U.S. market.

- With uncertainties and expectations of slower growth lingering, safe-haven assets such as bonds have been rallying. The U.S. Treasury (UST) 10y yield plunged to as low as 4.02% (lowest since mid-Oct’24) as investors reacted to the announcement. Similarly on the local front govvies rallied on subsequent to the announcement, with yields lower by 1 – 5 basis points (bps) across the curve.

Figure 3: Bond yields have declined since the start of 2025 (Source: Bloomberg)

Opus View

- The prospect of a global trade war remains a significant risk as governments assess the announcement. We expect global growth to decelerate, with potential for further weakening should there be retaliatory measures. Hence, we still see the trend of easing rate cuts continuing, as central banks attempt to support their economies.

- UST yields are expected to remain volatile, as the Fed navigates a very tricky environment of higher risk to inflation and slower growth. We maintain our forecast of a 0 – 50 bps rate cut by the Federal Reserve in the second half of 2025 in the US.

- Malaysia will face similar downward pressures to our gross domestic product (GDP) as exports slowdown in the next few months. We opine that Malaysia’s GDP growth will continue to be sustained by strong domestic consumption underpinned by the minimum wage increase, hike in civil servant salaries, and government cash handouts.

- In addition, the Malaysian Trade Ministry have decided against imposing retaliatory tariffs, and that it will attempt to negotiate instead. With this, our view on GDP growth remains within the range of 4.5% – 5.0% (BNM Expectations: 4.5 – 5.5%). We are also still expecting the overnight policy rate (OPR) to maintain at 3.00% for the time being. The actual impact to Malaysia still remains uncertain and would depend on the outcome of the negotiations.

- Looking forward, a reallocation of funds from equities to fixed income would be expected, mirroring the trend seen in the US. Given the risk-off environment, we anticipate that bond yields will trend lower, and that the domestic fixed income market will remain resilient and shielded from the volatility seen in USTs.

- With a duration range of 5 – 7 years, our portfolios are well-positioned to capitalize on the bond market rally, while also still focusing on high quality corporate bonds. We are positive on Malaysian Government Securities (MGS) and high-quality bonds which generally perform better in a weaker credit environment.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.