29 August 2025

SUMMARY

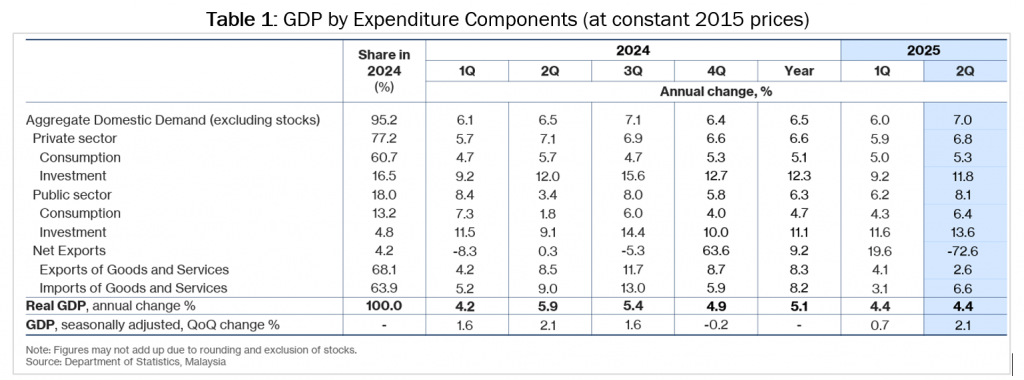

➤ Malaysia’s GDP grew 4.4% YoY in 2Q25, consistent with the growth in Q125. This performance was underpinned by robust private and public consumption, counterbalancing the drag from significant contraction in net exports.

➤ Total investment growth accelerated to 12.1% from 9.7% in 1Q25, the highest since 3Q24, attributable to further realization of new and existing projects supported by robust growth in fixed asset investments as evident in the strong inflows of foreign direct investment (FDI).

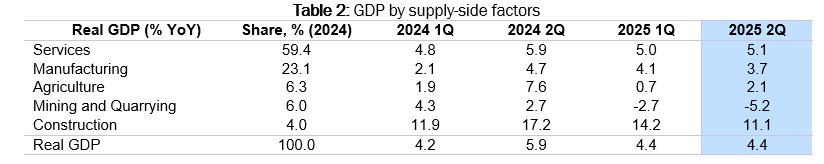

➤On the GDP supply side, services sector continues to anchor growth while construction sector held up its double-digit growth buffering contractionary trend in the mining and manufacturing sector. We expect both services and construction sector to maintain expansionary trend in 3Q25 while mining and agricultural remained vulnerable to global commodity prices and ringgit directions.

➤ There is silver lining in 3Q25, with manufacturing PMI and trade performance improved. Q3 Malaysia GDP is projected to remain resilient underpinned by E&E sector, while inflation is expected to remain benign. BNM OPR is expected to remain steady until year end however should growth prospects deteriorates below 4.0%, we anticipate another potential OPR cut.

➤ On the bond market, government yield curves could decline on narrower interest rate differential as US may start cutting rate as early as September. The market will also be supported by recovery of foreign fund flows observed in August as well as local investors. Therefore, we are maintaining our investment strategy of portfolio duration range within 5 – 7 years with overweight to high grade corporate bonds. Additionally, we look to enhance portfolio returns through strategic trading in the secondary market.

- Malaysia’s economy demonstrated resilience registering 4.4% year-on-year (YoY) in 2Q25, consistent with the pace observed in the previous quarter but tad lower than the advance estimate of 4.5%. It came in above Blomberg consensus forecasts of 4.2% YoY bringing the 1H25 GDP growth to an average of 4.4% (from 5.2% in the 2H24 and 5.1% in 1H24).

- The performance was underpinned by robust domestic demand,particularly private consumption and investment activity, counterbalancing the drag from a significant contraction in net exports. Private consumption recorded a larger gain of 5.3% YoY (1Q25: 5.0%) underpinned by positive labor market conditions and income-related policy measures including revision of minimum wage and civil servant salaries

- Total investment growth accelerated to 12.1% from 9.7% in 1Q25, the highest level since 3Q24. This comes after both private and public investments charted a double-digit growth of 11.8% (1Q25: 9.2%) and 13.6% (1Q25: 11.6%) respectively. The main factor was attributable to further realization of new and existing projects evident by robust growth in Machinery & Equipment and Structure which expanded by 16.6% (1Q25: 5.4%) and 10.5% (1Q25: 13.4%) respectively. Government spending increased by 5.3% (1Q25: 5.0%) contributed by higher spending on supplies and services.

- Net trade turned negative contributor, shaving 2.6% in 2Q25 (1Q25: +0.8%). This was mainly attributed to the decline in mining-related exports and higher capital imports which offset the continued electrical & electronics exports.

- On the supply-side, services sector continues to anchor GDP growth with an expansion of 5.1% as compared to preceding quarter of 5.0%. Agriculture expanded by 2.1% following a marginal growth of 0.7% in the previous quarter, supported by oil palm production. Manufacturing sector moderated to 3.7% against 4.1% in the preceding quarter due to disruptions in refined petroleum production. Construction held up its double-digit growth at 12.1% (1Q25: 14.2%) while mining sector contracted further by -5.2% (1Q25: -2.7%) on lower crude oil and natural gas output due to scheduled maintenance activities during the quarter.

STARTING Q3 2025 ON THE RIGHT FOOT

- Manufacturing sector saw softer moderation with S&P Manufacturing PMI grew to 49.7 in July, the highest reading since February 2025 with overseas sales expanded for the first time in eight months. New orders improved with only fractionally below the neutral 50.0 threshold, owing in part to an expansion in export sales for the first time in 8 months. However, input cost inflation accelerated for the third month to its highest level since November 2024, driven by rising raw material costs and weaker ringgit.

- July’s trade performance recovered by 3.8% YoY to RM265.9bn with export value surged by 6.5% significantly outpacing imports at 0.6%. Electronic and electrical (E&E) industry continued to be the key catalyst for trade performance accounting for 45.1% of total exports and 8.8% of total imports. The E&E sector posted strong performance with exports and imports growth expanded by 22.5% and 12.4% respectively. We expect a sustained upward trend for the E&E sector in line with the Ministry of Investment, Trade and Industry (MITI) ambition of reaching RM495 bn in export earnings until the finalization of the semiconductor tariff.

- Additionally, business sentiment globally also showed improvement as trade related to business investment edged higher. Notably, exports for machinery, equipment & parts also increased 15.9%. Imports grew for capital goods (20.6%) but fell for consumption goods (-5.0%), intermediate goods (-17.8%), and dual-use goods (-24.6%).

- Malaysia’s foreign direct investment (FDI) position increased by RM 2.2 bn to RM 1.0 trn as of end of 2Q25 (1Q25: RM 999.7 bn) with services sector remained the largest beneficiary of FDI totaling RM 547.8 bn followed by manufacturing sector and mining & quarrying. The top three countries for FDI position were Singapore (RM260.0 bn; 26.0%), Hong Kong (RM131.6 bn; 13.1%) and the United States of America (RM106.9 bn; 10.7%).

- Headline inflation ticked upward marginally to 1.2% YoY from a previous 4-year low of 1.1%. The increase was mainly driven by the higher prices in insurance and financial services (5.5%) as well as restaurant and accommodation services (3.3%) categories. Food and beverages1 and utilities2 both edged upward at a slower pace of 1.9% and 1.3% respectively. Core inflation, however, remained steady at 1.8% YoY for third consecutive months.

BOND MARKET OUTLOOK AND OPUS VIEW

- Looking ahead, we expect Q3 2025 GDP to remain resilient in the range of 4.0-4.5% (Bloomberg consensus: 4.0% YoY), factoring robust trade performance in July while sectoral tariffs have yet to finalize. We expect exports to remain steady as another round of front-loading activities may occur in anticipation of sectoral tariff announcements. Inflation is expected to remain subdued with cost pass-through spillover effects of higher global tariffs and expanded Sales and Services Tax (SST) may happen more gradually at moderate rates. Furthermore, stronger ringgit is expected to ease imported cost pressures thereby reducing producers’ incentives to pass costs onto consumers.

- We also estimate the Overnight Policy Rate (OPR) to remain stable until this year end, assuming that Malaysia’s economic condition remains steady for Q3 and Q4 2025. However, another 25bps rate cut is within our projection if the full year 2025 GDP comes in below 4%.

- While Malaysia continued to strengthen the E&E industry position globally to support economic growth via National Semiconductor Strategy (NSS), the outlook remained relatively uncertain with US President Trump’s proposed tariffs (100-300%) on semiconductor chips imported from countries not producing in US. It is estimated that the growth trajectory for the full year of 2025 may reduce between 0.6% to 1.2%, according to the Investment, Trade and Industry Minister Tengku Datuk Seri Zafrul.

- In the near term, we view that the local yield curves could decline on the back of a narrower interest rate differential as the US Federal Reserve may cut rate as soon as September. Notwithstanding that, tariffs developments, interest rate expectations, and broader economic conditions will also shape the yield curves. Nevertheless, local bond market will be supported by recovery of foreign fund flows observed in August (RM5.2 billion as of 13 August 2025) as well as local investors.

- We are maintaining our investment strategy of portfolio duration within 5 – 7 years with overweight exposure in high grade corporate bonds to minimize credit downgrade risk in a slowing growth environment. Additionally, we look to enhance portfolio returns through active trading in the secondary market.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.