30 September 2025

SUMMARY

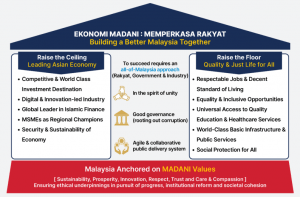

➤ Budget 2026 will remain supportive, focusing on fiscal consolidation and economic resilience under the Ekonomi Madani framework, with three key pillars: raising national growth ceiling, uplifting living standards floor and bolstering reforms for good governance and institutional integrity.

➤ We expect no major corporate tax changes amid global uncertainties, except for taxes aligned with climate commitments and healthcare initiatives. Revenue collection will shift toward targeted measures, while estimated expenditure of RM86–88 billion will be supported by direct and indirect taxes.

➤ We see government debt issuance to moderate further to RM160–165bn in 2026. In near to medium term, the local yield curve will be shaped by global and domestic factors, with foreign fund inflows supported by fiscal discipline and stable conditions, while rising corporate issuance may add upward pressure on longterm yields.

➤ Therefore, we widen duration strategy to a target range of 4.5–7 years (previously: 5-7 years) to allow room for profit-taking and portfolio rebalancing to take advantage of recent profit-taking activities, with an overweight position in high-grade corporate bonds, trading at a reasonable yield, as part of our strategy to balance risks and returns.

- Budget 2026, scheduled to be tabled on 10 October 2025, is expected to provide greater clarity on fiscal priorities while reinforcing economic resilience amid global uncertainties. The upcoming budget will be the fourth in series of MADANI Budget will see limited major policy shifts as the anticipated budget continued to be guided by Ekonomi Madani framework and alignment with the 13MP (13th Malaysia Plan).

- Next year’s budget focus will continue to advance Ekonomi Madani framework and pivots on three (3) main pillars; raising national growth ceiling, uplifting living standards floor and bolstering reforms for good governance and institutional integrity. As compared to previous budget announcements, Budget 2026 is expected to focus on governance overhaul and technological advancement and targeted social upliftment.

- We expect no drastic corporate tax hikes or cuts as Finance Ministry has indicated that it will avoid broad new taxes amid global uncertainties. However, the new carbon tax could potentially be introduced to align with the country’s energy transition and climate commitments and there could possibly be a revision to sin and health taxes, which could be channeled to fund healthcare initiatives.

Figure 1: Ekonomi Madani Framework

FISCAL REVENUE

Due to slowing economy and elevated global uncertainties, we expect the government to have limited capacity to introduce new tax, prioritizing measures that are people-centric approach which places the needs of the communities at the heart of public policy. We anticipate a strategic shift in revenue collection towards targeted tax measures and non-tax sources, supported by a full-year contribution from the expanded Sales and Services Tax (SST) and enhanced e-invoicing compliance. In terms of what we are expecting for the upcoming budget:-

- The cost-savings from the introduction of RON95 subsidy reform (BUDI95) is expected to save the government approximately RM 2 – 4 bn annually in subsidy costs.

- Introduction of carbon tax for iron, steel and energy industries with clarity on the mechanism and timeline as Malaysia continues to move forward to net-zero 2050 goal. The plans to implement a carbon tax by 2026 coincides with the commencement of the European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM) regime — a carbon tariff imposed on carbon-intensive products imported into the EU to equalize discrepancies in carbon prices globally.

- Capital gains taxes (‘CGT’) which were introduced in 2024 for unlisted shares which applies to disposals by companies, limited liability partnerships, cooperatives and trusts. Exemptions are provided for disposal gains from restructuring within the same group, approved initial public offerings (‘IPO’) and venture capital companies. However, there are current tax reporting mismatches for the disposal completion date which we anticipate being clarified in the upcoming budget.

- Potential extension of foreign sourced income which is set to expire on 31 December 2026.

- Pro-health taxes could be adjusted higher for cigarettes (last revised in 2014) and vape-related products (last revised in 2023) in line with healthcare reform outlined in 13MP, especially since the current tax per milligram of nicotine in vape liquids (vape liquid: RM0.008-0.067; cigarettes: RM0.22-0.33) remain relatively low.

- Goods and Services Tax (GST) and High Value Goods Tax (HVGT) will not to be tabled, as the broadened Sales and Services Tax (SST) framework encompasses such coverage.

- Visit Malaysia 2026 will be announced for boosting tourism sector (contributing 15.1% to GDP in 2024) and support trade activities. We anticipate there would be announcements for increased in matching grants to elevate Malaysia through various tourism events and promotional activities.

- Possibly lower dividend upstream from Petronas on the back of a lower oil price environment (24 Sept: USD68.30/barrel; YTD decline: -8.49%). However, we expect other direct taxes from real property gains tax (RPGT’) and stamp duty to be higher underpinned by expansion in the real estate market.

- Clarity on the Qualified Domestic Minimum Top-Up Tax (QMDTT) which sets a global minimum effective tax rate of 15% for large multinational enterprises (MNEs) with revenues above EUR750mn. This allows the government to collect additional tax from those companies with financial years starting on or after 1 January 2025 (OECD estimates yield: 0.05–0.15 % of GDP or RM1-3bn).

- Multi-tier levy on foreign workers, reaffirmed in the 13MP, should see more details of mechanisms with the actual implementation likely to be deferred to provide sufficient adjustment space for firms.

- E-invoicing will take effect in January 2026 through a phased rollout based on annual revenue thresholds, with full implementation scheduled for 1 July 2026. Hence, there would be additional tax incentives for the implementation of E-invoicing.

FISCAL EXPENDITURE

Malaysia’s Budget 2026 is estimated to record higher expenditure of RM86-88 bn, driven by the first-year rollout of the 13MP. This should be cushioned by both direct and indirect taxes while the government maintains a disciplined spending approach, prioritizing measures that stimulate private consumption, strengthen the labour market, and promote socioeconomic advancement and sustainable economic growth.

- Targeted subsidy mechanism is expected to progress further through enhanced utilization of the PADU system, aiming to exclude the upper-income group for efficient subsidy allocation in phases.

- RON95 and electricity subsidies based on the newly introduced mechanism this year are expected to yield fiscal savings. We expect the cost-savings to the government is circa RM 2 – 4 bn annually, while the expenditure at approximately RM10bn.

- Social assistance could be included to further reduce living costs and ensure domestic consumption remains resilient amid external challenges. We expect the continuation of Sumbangan Asas Rahmah (SARA) program. Stamp duty exemption for eligible first-time homebuyers on tiered range of property value could be extended for another year of assessment.

- Rural infrastructure upgrade is expected to remain a priority to enhance connectivity and support inclusive development. There would be more infrastructure allocation towards refurbishing dilapidated schools and amenities, flood mitigation projects and roads connectivity.

- Micro Small Medium Enterprises (MSMEs) is likely to continue receiving matching grants or preferential loan rates for adopting digital technologies, financing facilities, and tax & regulatory incentives.

- Government-linked Enterprises Activation and Reform (GEAR-uP) programme and Public Private Partnership Unit (UKAS) to reinforce inclusivity and sustainable economic resilience.

- Phase 2 of civil service salary adjustments ranging from 3-7% which previously scheduled for January 2026 will remain intact to support wage growth and domestic consumption.

- Regional development as the government aims to diversify economic growth beyond established urban centers, potentially positioning Malaysia as the regional hub for electrical vehicle manufacturing.

SECTORAL FOCUSED POLICIES

As outlined in the 13MP, Malaysia aims to drive growth in manufacturing sector and prioritizing high-value industries such as semiconductors, artificial intelligence, renewable energy to drive industrial transformation. These strategic sectors are expected to be the spotlight in Budget 2026, with continued policy support and targeted investments to accelerate innovation, sustainability, and global competitiveness.

- Semiconductors, Artificial Intelligence, Renewable Energy are expected to continue to receive government incentives for research and development, digitalization, aligning national policies and roadmaps to drive economic growth.

- Construction sector could see at least one or two state-level projects (potentially Penang and Johor) being announced while new federal projects to refurbished public amenities e.g. hospitals, schools, polytechnics etc, could be reintroduced.

- Property sector may see measures for boosting homeownership (part of 13MP reforms) with expansion of rentto-own models or promotion of build-then-sell arrangements. The stamp duty exemption for eligible first-time homebuyers could be extended to encourage home ownership.

- Islamic Finance and economy may benefit from duty exemptions to enhance market access, grants for while youth entrepreneurs in the sector could receive targeted incentives to encourage innovation and participation.

- Export-oriented sector would also be likely to receive support from the government given the recent trade policies shift. Therefore, we would expect more capital tax allowances for equipment the exporting manufacturers.

FISCAL CONSOLIDATION

- Fiscal consolidation efforts are expected to persist, with the government targeting a fiscal deficit of 3.6% (target for 2025: 3.8%; 2030: <3.0%). This should be boosted by more targeted measures, focusing on efficient spending and higher tax revenue collection as well as strategic allocation of resources to priority sector. As for this year, we view that the fiscal deficit target is on track in meeting the target of 3.8%. For 1H2025, fiscal deficit has narrowed to -RM40.5bn (6M2024: -RM51.6), reflecting disciplines fiscal management.

BOND MARKET OUTLOOK AND OPUS VIEW

- We expect Budget 2026 to focus on people-centric approach, carefully balancing external challenges such as a slowing global economy, geopolitical tensions, and policy shifts, while continuing efforts toward fiscal consolidation and preserving economic resilience. As we assume the government continues the fiscal consolidation effort, we anticipate government debt issuance to continue moderating (estimation for

2026:RM160-165mn) in the coming years (2025:RM168.5mn; 2024: RM175mn), in line with ongoing fiscal consolidation efforts. - For the bond market, the near to medium-term trajectory of the local benchmark yield curve will remain largely shaped by global macroeconomic conditions, trade developments, interest rate trends, and geopolitical risks. The government’s commitment to fiscal discipline, alongside stable political and economic conditions and a gradual pace of interest rate cuts by major central banks, is expected to support the continued momentum of foreign fund inflows. Domestically, rising corporate bond issuance (6M2025: RM94.23bn 2024: RM124.15bn;

2023: RM118.3bn) amid a moderation in government debt supply could also exert upward pressure on yields. - Over the remainder of 2025, we also expect the local benchmark yield curve to ease as the interest rate differential narrows as the US Federal Reserve commenced its monetary policy easing cycle (September FOMC Meeting: -25bps), which includes two additional rate cuts as indicated in the September Fed Dot Plot. The curve is likely to steepen modestly, with short-term rates anchored by expectations that Bank Negara Malaysia will maintain its policy rate through the remainder of 2025. In contrast, the long end may face upward pressure due to increased corporate bond supply and persistent global risk sentiment.

- We widen duration strategy to a target range of 4.5–7 years (previously: 5-7 years) to allow room for profittaking and portfolio rebalancing to take advantage of recent profit-taking activities, with an overweight position in high-grade corporate bonds, trading at a reasonable yield, as part of our strategy to balance risks and returns.

Table 1: Previously tabled Malaysia Budgets

| BUDGET YEAR | BUDGET THEME | PERSONAL TAX CHANGES | CORPORATE TAX CHANGES | INDIRECT TAXES & OTHERS |

|---|---|---|---|---|

| 2021 | COVID Recovery & Resilience | 1% income tax cut for RM50k–70k bracket (middle income). No new taxes on individuals | Review of tax incentives for companies relocating their operations to Malaysia and undertaking new investments. | No SST/GST changes. EPF minimum contribution reduced to 9% to boost disposable income |

| 2022 | Keluarga Malaysia, Makmur Sejahtera | No rate changes. Expanded reliefs e.g. lifestyle relief, education relief, etc. | One-off Cukai Makmur (‘Prosperity Tax’) where 24% tax rate being levied on the first RM 100 mil chargeable income followed by 33% tax rate for the remaining chargeable income. | Introduction of low value goods tax not exceeding RM 500. Excise duty on pre-mixed drinks with sugar content. |

| 2023 | Membangun Malaysia Madani (Retabled) | Raised top bracket tax rates by 0.5–2% for high-income group >RM100k; reduction for middleincome group by 2% for income ranges RM35k–100k | Reduction in corporate tax rate from 17% to 15% for firms with 150k first chargeable profit. Tax incentives for carbon capture and storage | Luxury goods tax introduced on high-value items (e.g., luxury watches, handbags) effective 2023. Reimplementation of tax disclosure amnesty program was launched with penalty waiver of 100% from 1 June 2023 to 31 May 2024 |

| 2024 | Economic Reforms, Empowering the People | Maintaining 2023s tax bracket. | Implementation of capital gains tax (10% on unlisted company shares from March 2024; exemptions for IPOs/reorgs). | Increase in service tax rate from 6 to 8% with expansion of taxable service scope. Luxury / High value goods tax reiterated. |

| 2025 | Fiscal Discipline & Strategic Investment (13MP) | Imposition of tax on dividend received by individual shareholders (“Dividend Tax”) | Global Minimum Tax (15%) for multinational enterprises (MNE) starts in YA2025 operating in at least 2 jurisdictions and annual revenue of EUR 750 mil. | Broadening of sales tax base. Increase in sales tax rate from 5 – 10% for nonessential goods. |

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.