18 July 2025

SUMMARY

➤ The US government announced a surprise 25% tariff on Malaysian exports effective 1 Aug’25 and threatened to impose an additional 10% tariff on countries aligned with BRICS.

➤ The direct impact of US tariffs on Malaysia’s overall exports is limited as sector-specific details remain under review. Nevertheless, eight sectors with at least 25% exposure to the US market may face significant setbacks unless effective diversification strategies are implemented.

➤ Opus projects Malaysia’s annual GDP growth to range between 3.5%-4.5% in 2025. We remain optimistic that Malaysia could negotiate a lower tariff rate in the range of 15-20%, which may reduce exports by 8-12% year-on-year.

➤ Benchmark MGS yield curve movement was muted following the announcement. Market volatility will persist in 2H2025 with US yields to stay elevated while MGS yields are expected to remain steady on strong macro fundamentals, steady net foreign inflows and a supportive monetary policy.

➤ Hence, we are maintaining our investment strategy of portfolio duration within 5 – 7 years with overweight exposure in high grade corporate bonds to minimize credit downgrade risk in a slowing growth environment. Additionally, we look to enhance portfolio returns through active trading in the secondary market.

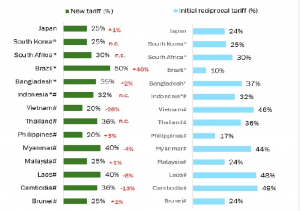

- On 8 Jul’25, the US government announced a surprise 25% tariff on Malaysian exports, effective 1 Aug’25. The tariff rate was one percentage point higher than the figure announced in April, sparking public confusion, especially after the Ministry of Investment, Trade and Industry had earlier stated that June’s trade negotiations with the US had made ‘good progress’. Nonetheless, the 25% tariff is separated from all sector-specific tariffs1 and includes the base rate of 10%. The benchmark MGS yield curve movement was muted, with the 10-year yield remaining flat as of 8 Jul’25 as investors focused on monetary policy decision scheduled for the following day. Nevertheless, the Minister reiterated that a positive deal could still be reached in the coming weeks while aiming for a fair-trade deal.

- Additionally, US President Trump threatened to impose an additional 10% tariff on countries aligned with BRICS. This could further complicate the prospects of securing a favorable deal as he claims these countries are pursuing ‘anti-American’ policies, particularly after Malaysia was recognized as a BRICS partner country last October. Amid rising tensions, Malaysian Prime Minister Anwar has called on BRICS to follow ASEAN’s example by promoting trade in local currencies and enhancing intra-member trade.

Chart 1: Jul’25 tariff level announced by US President Trump

Note: n.c. refers to no changes, # refers to ASEAN members and * refers to BRICS members.

Source: US Bureau of Economic Analysis.

What does it mean for Malaysia?

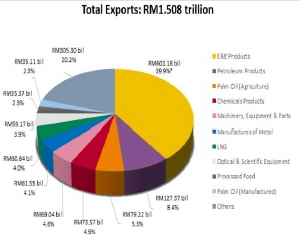

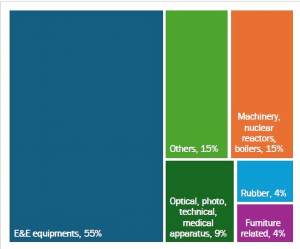

- The direct impact of US tariffs on Malaysia’s overall exports is limited, though global uncertainties may still weigh on trade performance through weaker sentiment. Of all export categories, electrical and electronic (E&E) products led as the top contributor in 2024, making up nearly 40% of Malaysia’s total exports. Meanwhile, Malaysia’s exports to the US were mainly on E&E products accounting for 55%, with semiconductor-related items making up around 7%. Due to the tariff exemption on E&E products that has remained in effect, the impact of the 25% US tariff on Malaysia is expected to be broadly consistent with the Apr’25 reciprocal tariff, pending sector-specific reviews.

Chart 2: Top 10 major export products in 2024

Source: Malaysia External Trade Development Corporation.

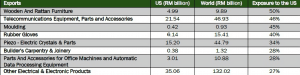

Chart 3: Major exports to the US

Source: Malaysia External Trade Statistic, DOSM.

- On the sectoral front, there are a total of eight sectors with at least 25% exposure to the US market (see Chart 3). The furniture sector has the highest exposure to the US market, with 50% or nearly RM5 billion of its exports directed there. Given the reliance of these eight sectors on the US market, their sectoral performance may be clouded by the imposition of US tariffs, especially in the absence of effective diversification strategies to reduce dependency. Consequently, these sectors may face declining demand, compressed profit margins, and slower growth.

Chart 4: Sectors with at least 25% exposure to the US market

Source: Malaysia External Trade Statistic, DOSM.

- As for E&E, we see limited risks from a potential tariff on this category. This is primarily because Malaysia’s semiconductor industry is heavily concentrated in back-end operations such as assembly, testing, and packaging, which are not the main targets of US trade restrictions. Current US export control measures primarily target the transfer of advanced chip technologies to strategic competitors such as China due to national security concerns and efforts to maintain technological leadership. On a related note, Malaysia could gain a strategic advantage in the global chip race if the semiconductor supply chain moves up the value chain and positions itself as a key diversification hub for US semiconductor companies. If an E&E-focused tariff were to be imposed later, any slowdown in Malaysia’s E&E and semiconductor sectors would likely stem from global trade disruptions rather than the direct impact of the tariff itself.

- Opus projects Malaysia’s annual GDP growth to range between 3.5%-4.5% in 2025, driven by stable domestic demand and a favorable monetary policy stance, while factoring in global headwinds such as slowing economic momentum and elevated inflation. Based on internal projection, a 20-25% tariff on Malaysian exports as the base case could deteriorate the exports by 15-20% year-on-year (YoY). However, we remain optimistic that the Malaysia could negotiate for a lower tariff rate at the range of 15-20%, which could lower the export by 8-12% YoY. This assumption draws from the recent example of Vietnam and Indonesia, which successfully secured a lower tariff of 20% and 19% in contrast to higher initial proposals. It suggests that Malaysia may have room to negotiate more favorable terms.

- The economy momentum is expected to be sustained despite the ongoing external headwinds as reflected in the Malaysian Economy Indicators that provide signals on local economic movement. Coincident Index, an indicator measuring the current economic activity, remained at the healthy level of 126.7 in April. Meanwhile, the Leading Index, a broader indicator of the economy’s future direction, improved by 0.8% month-over-month (MoM) in April, marking the second consecutive monthly gain and the highest reading since last December.

BOND MARKET OUTLOOK AND OPUS VIEW

- The renewed escalation of global trade tensions in July 2025 is expected to further increase global uncertainties. We anticipate market volatility to persist in the second half of 2025, driven by key economic data releases, concerns over tariff-induced inflationary pressures, fiscal health challenges in major economies, and monetary policy decisions by major central banks.

- For the bond market, the US Treasury yield curve may remain elevated as investors remain cautious about inflation trends which could divert the rate cut expectations in 2H2025. Rising concerns about long-term economic health weighed down by a growing fiscal deficit over the decade may also put pressure on the movement of the US yield curve. Amid shifting global investment flows as reflected by a weaker dollar (YTD: – 9.27%) and net foreign inflow into Malaysia’s bond market (YTD: RM3.57 bil), local bond market is expected to remain favorable among investors seeking diversification. Coupled with steady macroeconomic conditions and a supportive monetary policy, the MGS yield curve will remain stable in the long-term.

- As such, we are maintaining our investment strategy of portfolio duration within 5 – 7 years with overweight exposure in high grade corporate bonds to minimize credit downgrade risk in a slowing growth environment. Additionally, we look to enhance portfolio returns through active trading in the secondary market.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.