15 August 2025

SUMMARY

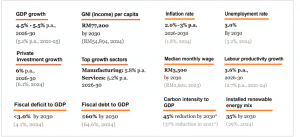

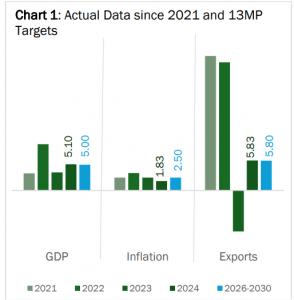

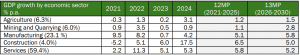

➤ The 13th Malaysia Plan (13MP) sets targets for GDP growth (4.5-5.5%). It outlines a total expenditure of RM611 bn while targeting key economic sectors like manufacturing, AI, and the green economy. The plan’s success hinges on disciplined spending, tax reforms, and robust governance to navigate external headwinds and ensure long-term resilience.

➤ Revenue-to-GDP is projected to decline to 14.1% from 15.6% in the 12MP. While total revenue is expected to rise in absolute terms at RM1,820.6 bn or RM364.1 bn annually during 13MP period, the decline in the ratio suggests absence of significant tax reforms or new revenue streams in the near term.

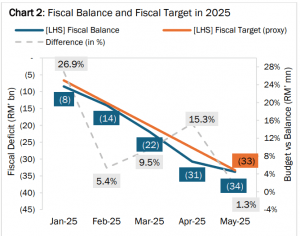

➤ Fiscal deficit is targeted to fall below 3.0% of GDP by 2030, reducing the debt-to-GDP ratio to below 60%. Currently, we are optimistic that the fiscal deficit-to-GDP ratio target of 3.8% (RM8Obn) for 2025 remains intact, supported by revenue-enhancing measures.

➤ The local bond market may be influenced by the implementation of the 13MP initiatives in the medium to long term and the yield curve could decline on narrower interest rate differential in the near term. We expect Budget 2026 to provide greater clarity based on the rollout of 13MP with key implementation details.

➤ We are maintaining our investment strategy of portfolio duration within 5 – 7 years with overweight exposure in high grade corporate bonds to minimize credit downgrade risk in a slowing growth environment. Additionally, we look to enhance portfolio returns through active trading in the secondary market.

- The 13th Malaysia Plan (‘13MP’) was tabled in Parliament on 31st July 2025, as continuation of 12th Malaysia Plan (‘12MP’) 2021 – 2025, marking a critical juncture in the nation’s 2026 – 2030 roadmap towards ‘raising economic floor and ceiling’. With the theme Melakar Semula Pembangunan (Reshaping Development), it comprises of three key dimensions (Increasing Economic Diversification, Holistic and Quality Living Standards & Sustainability) under the Madani framework supported by four (4) main pillars of which cover 27 focus areas, 46 strategies and 600 initiatives.

- 13MP sets an ambitious but achievable targets aimed at transforming Malaysia into an AI driven high-income high-value nation while strengthening rural developments and tackling rising costs of living. While 12MP allocated RM400 bn in development expenditures (DE) solely from the fiscal side, the total funding was increased to RM 611 bn under the 13MP.

- Out of the total allocation of RM611 bn, the government has allocated RM430 bn for DE (annually: RM86 bn), RM120 bn for the Government-linked Enterprises Activation and Reform (GEAR-uP) program, and RM61 bn for public-private partnership projects under Unit Kerjasama Awam dan Swasta (‘UKAS’). Of the RM430 bn allocation, 52.8% will be channeled to the economic sector, 30.9% to the social sector, 11.8% to security, and 4.0% to administrative functions.

- On the revenue front, the ratio of revenue to GDP is projected to decline to an average of 14.1% down from 15.6% in the 12MP and 16.8% in 2024. While total revenue is expected to rise in absolute terms, reaching RM1,820.6 bn or RM364.1 bn annually, a 27.1% increase from the 12MP, the decline revenue-to-GDP ratio suggests the absence of significant tax reforms or new revenue streams in the near term. The government appears to be prioritizing domestic demand stability by holding off on measures that could trigger inflationary pressures or political resistance.

Key Targets and Projections in 13MP (figures in parentheses reflecting latest published data)

Source: DOSM, 13MP.

Source: DOSM, 13MP.

Source: CEIC, DOSM, MOF.

- Fiscal deficit is targeted to fall below 3.0% of GDP by 2030 with debt-to-GDP ratio to fall below 60%.We view that Malaysia is on track to achieve its targeted fiscal deficit-to-GDP ratio of 3.8% (RM8Obn) for the year as the difference between actual fiscal balance (RM34 bn) and fiscal target (RM33 bn) for the first five months is only at 1.3%. Moreover, we are optimistic that the fiscal position this year will be further strengthened by gradual implementation of revenue-enhancing measures such as targeted diesel subsidy (RM7.5 bn), SST scope expansion (RM5 bn) and the upcoming fuel subsidy rationalization (RM4 bn).

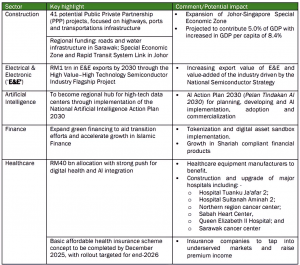

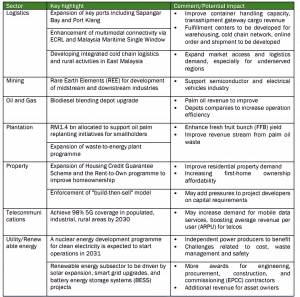

- Based on the 13MP, manufacturing is expected to grow 5.8% annually, supported by electrical and electronics (E&E) subsector, high-tech and high-value products, and the promotion of “Made by Malaysia” goods. The Plan also places a strong emphasis on Artificial Intelligence (AI) adoption through the National Artificial Intelligence Plan 2030 to facilitate the integration of AI across sectors. Additionally, it also lays out initiatives to accelerate the nation’s transition to low-carbon development, stating that the green economy will serve as a core development model.

Table 1: Actual GDP growth by economic sector since 2021 and a comparison between 12MP and 13MP

Source: DOSM, MOF

Table 2: Key highlights from 13MP by sector

Source: Various sources.

BOND MARKET OUTLOOK AND OPUS VIEW

- The 13MP is designed to guide Malaysia’s development towards a high-income nation by 2030, with its long-term success hinging on effective implementation. The government must adopt a flexible and robust governance framework for fiscal policies, focusing on prudent consultation to prevent fiscal leakages, inefficiencies and weaknesses in implementations.

- Amid persistent headwinds rising from political shifts, trade barriers, geopolitical risks and climate change, rebuilding the fiscal buffer should remain priority through efficient public spending and sustainable tax reforms. Beyond these measures, structural reforms including the adoption of digitalization and fostering stronger regional ties are important to ensure long-term resilience and sustained economic growth.

- Over the medium to long term, the local bond market may be shaped by the implementation of initiatives under 13MP as these could alter the government’s fiscal trajectory, public debt issuance, and the country’s credit risks profile as well as macroeconomic conditions. Notwithstanding that, the global economy outlook, trade development and policy shifts in major economies will also influence the yield curves.

- In the near term, we anticipate that the yield curve could decline on narrower interest rate differential as the US Federal Reserve may start easing monetary policy as soon as September. The yield curve’s trajectory will also be shaped by tariffs developments, interest rate expectations, and broader economic conditions. Nevertheless, we expect Budget 2026 to provide greater clarity on growth and policy direction based on the 13MP rollout.

- We are maintaining our investment strategy of portfolio duration within 5 – 7 years with overweight exposure in high grade corporate bonds to minimize credit downgrade risk in a slowing growth environment. Additionally, we look to enhance portfolio returns through active trading in the secondary market.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.