By Opus Asset Management Sdn Bhd.

Russia has started its invasion into Ukraine; the rest of the world retaliates with sanctions.

After failed diplomatic talks and a military build-up on Ukraine’s borders over the past month, the President of Russia, Vladimir Putin has escalated the situation by ordering a “special military operation” into Ukrainian lands, with claims on Ukraine’s independence. This has been met with sanction by Western countries such as US and Germany, although crucially Russia’s energy exports have yet to be targeted as of writing which may restrict further energy price rises.

Commodities the clear beneficiary due to export-heavy Russian economy.

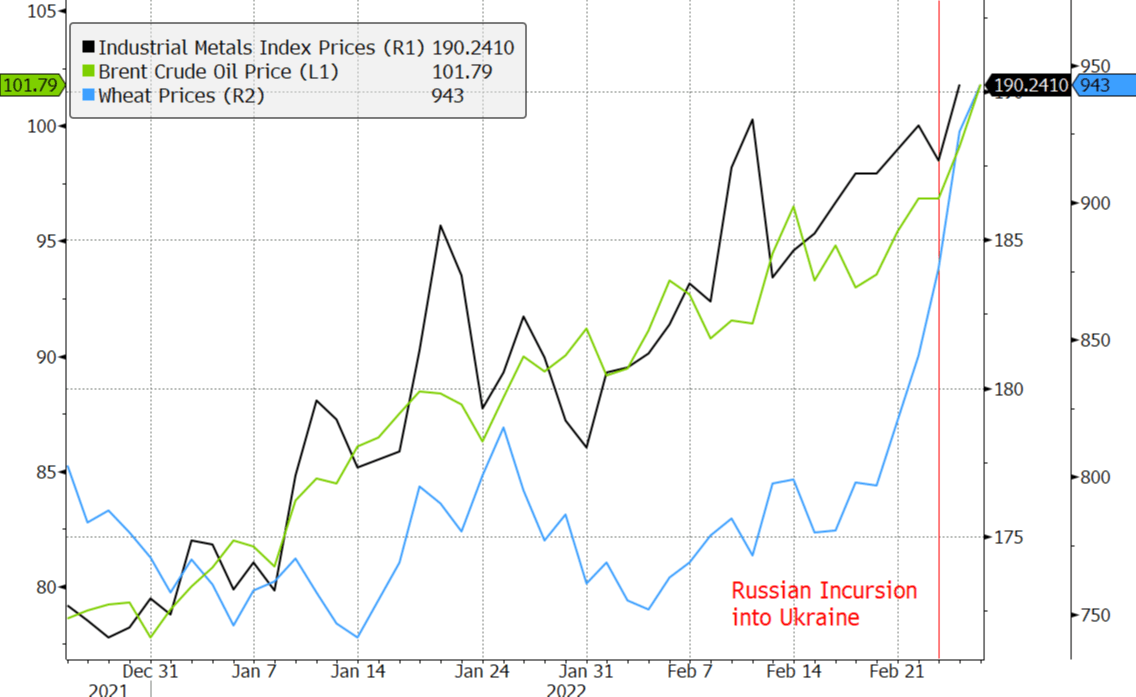

Mirroring the rising hostility on the Russo-Ukrainian border, commodities ranging from fuels, metals to crops increased sharply as per Exhibit 1. Notably, Brent crude oil prices have exceeded the USD100 level. We expect rising commodity prices to be the main effect of the Russia-Ukraine conflict, due to the position of Russia as the world’s 3rd largest petroleum

producer. For foodstuffs, Russia and Ukraine are together also responsible for almost 30% of global barley and wheat exports.

Exhibit 1: Commodities spiked upon commencement of Russian invasion

Source: Bloomberg

Our view:

• Risky assets were hit hardest, but have since bounced back.

Risky asset classes were impacted the most, as global equity indices in Europe, US declining by as much as 4% before an equally sharp rebound. Nonetheless, the fluid developments suggest that markets are likely to remain choppy in the near term.

• Bond markets, in particular US Treasuries (UST), benefits from safe haven flows, but upside is limited by impending interest rate hikes.

The current development has not changed the expectation of the Fed to start hiking the interest rate next month. High inflation is the main motivator of earlier-than-expected and more aggressive policy tightening, and this has not changed. In fact, inflation is expected to rise even further, given the rise in energy prices and other key commodities.

• Global growth may be impacted.

If the current tension escalates or prolongs. Together with rising interest rates, the risk of a global slowdown in growth is now higher. This could then lead to the undesirable outcome of stagflation (high inflation and low growth).

• Malaysian economy to remain insulated due to commodity-oriented exports and secure trade profile.

Malaysia should benefit from its commodity-driven exports (palm oil and petroleum) in an environment of high commodity prices. This would provide the government sufficient room to maintain subsidies on the prices of fuel and controlled goods, thus limiting the impact on Malaysian inflation.

• Neutral on impact to Malaysian bond market.

While there may be some risk of foreign outflows from Emerging Markets with safe haven flows to UST, we believe Malaysia will be least impacted, being a commodity-exporting country. There is a slight risk that outflows from the Malaysian bond market may occur from a more aggressive Fed that is forced to hike faster than expected to combat the increase in inflation. To this, we would note that the Malaysian yield curve have already risen significantly in 2021 by almost 100bps, with yields already above or near pre-pandemic levels in 2019.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.