- Budget 2024 sees higher expenditure but with fiscal discipline considered. Budget 2024’s total expenditure is tabled higher at RM393.8bil compared to RM388bil in Budget 2023 re-tabled February this year. This was underpinned by higher projected government revenue at RM307.6bil, leading to a lower absolute fiscal deficit of RM86.2bil (2023: 96.5bil) and fiscal deficit-to-GDP ratio of 4.3% expected in 2024 compared to the current 5%,

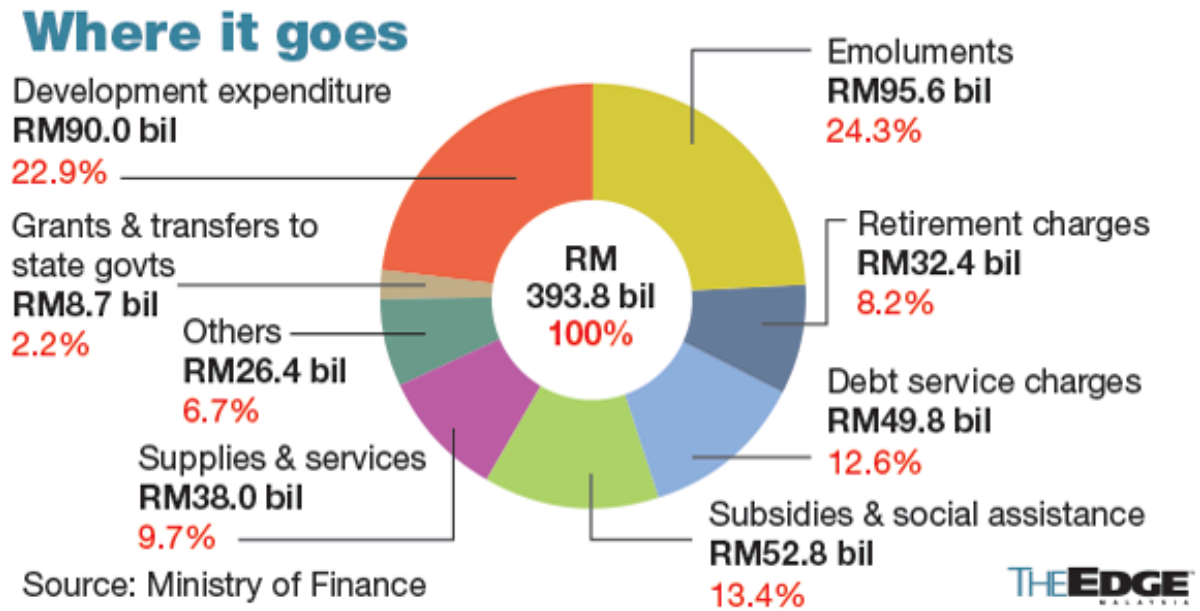

- Bulk of rise in expenditure is due to higher Operating Expenditure (OPEX) allocation in Budget 2024 by RM14.7bil. Despite lower allocation for subsidies and social assistance at RM52.8bil (2023: RM59bil), civil servant emoluments remain elevated at RM95.6bil (2023: RM90.9bil) making up 24.3% of total expenditure. Although development expenditure (DE) seems relatively lower at RM90.1bil (2023: RM94.9bil), this was distorted by the inclusion of USD3bil equivalent amount for the repayment of 1MDB bonds in Budget 2023 DE.

- The largest beneficiaries are the education and healthcare ministry, which was allocated RM58.7bil and RM41.2bil respectively for the expansion of facilities. We are also likely to see positive spillover effects into the construction sector with RM11.8bil allocated for flood mitigation projects and RM2.8bil for federal road repairs. Other notable projects include LRT3, which was allocated RM4.7bil to resume constructing 5 stations that was previously cancelled and RM2bil to support the National Energy Transition Roadmap (NETR),

Figure 1: Budget 2024 expenditure elevated due to higher operating expenditure

Source: The Edge, MOF

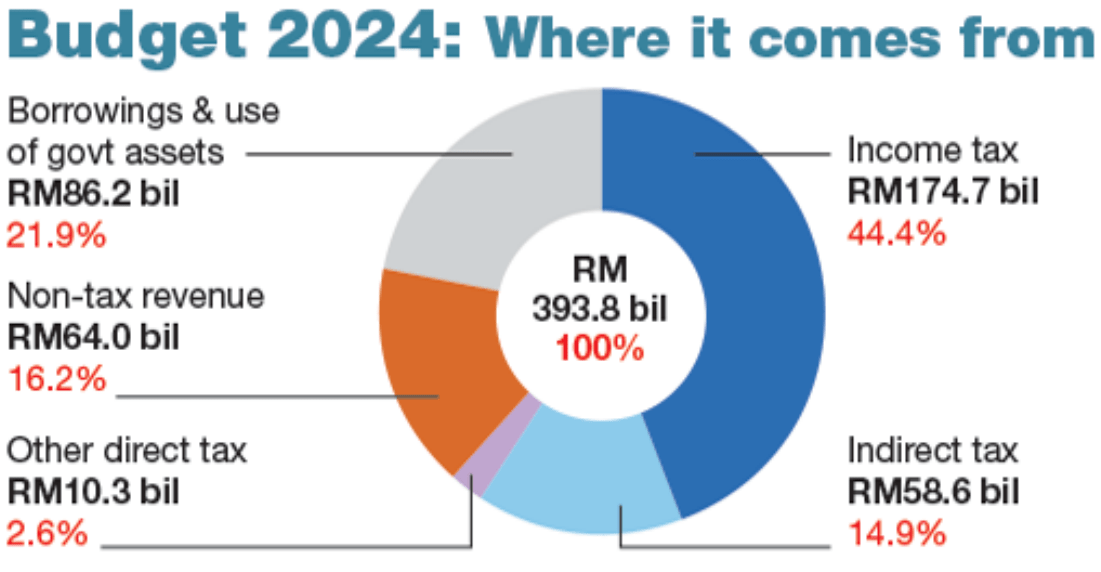

- Government foresees higher revenues in 2024 at RM307.6bil (2023: RM291.5b) from better direct tax collection. Strong earnings prospects and better tax compliance will underpin better corporate tax revenue while positive employment outlook and wage growth will continue to support individual income tax collection. However, dividend from Petronas is projected lower at RM32bil (2023: RM40bil), reflecting lower reliance on petroleum related revenue.

Figure 2: Budget 2024 will largely be supported by direct tax revenue

Source: The Edge, MOF

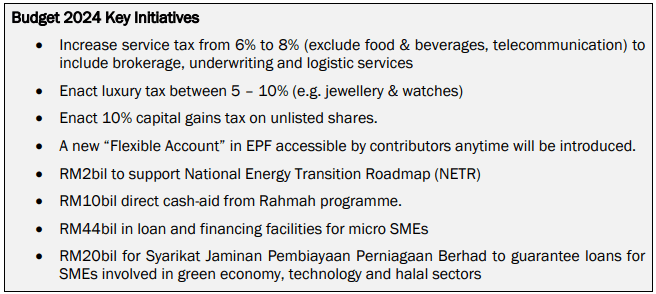

- Government will enhance tax collection through increment in service tax from 6% to 8% to include brokerage, underwriting and logistics (while excluding telecommunication, food and beverages). Moreover, attempts to widen tax base was seen in the implementation of luxury goods tax ranging between 5% to 10% for domestic consumers and 10% capital gains tax on unlisted shares.

- Government to implement targeted subsidies as reflected in increased allocation to cashaid from RM8bil to RM10bil, while shifting away in phases from blanket subsidies on items like electricity, diesel, cooking-oil that saw significant price increase amid higher commodity prices in recent years. Meanwhile, ceiling prices on poultry and eggs will be lifted.

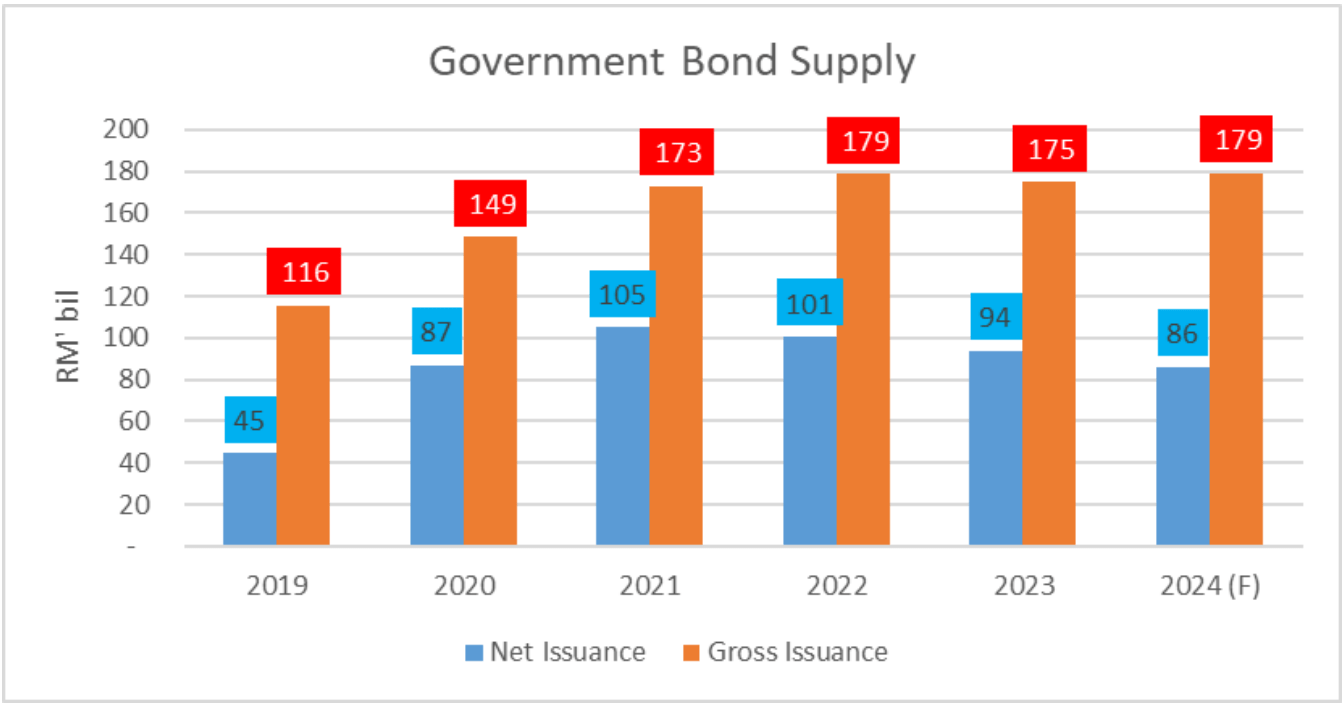

- Government bond supply expected to total RM179bil for 2024 due to higher maturities. Malaysian government bond (MGS and GII) supply will remain elevated due to an increase in maturities for 2024, despite the lower projected fiscal deficit level for Budget 2024 (~RM86bil) compared to Budget 2023 (~RM94bil). It is likely that the market will have to continue absorbing a similar supply of government issuances going forward, especially in 2026 where there is a maturity wall of ~RM99bil.

Figure 1: Higher maturities should lead to elevated government bond supply in 2024

Source: Bloomberg, Ministry of Finance, BNM, Opus Asset Management

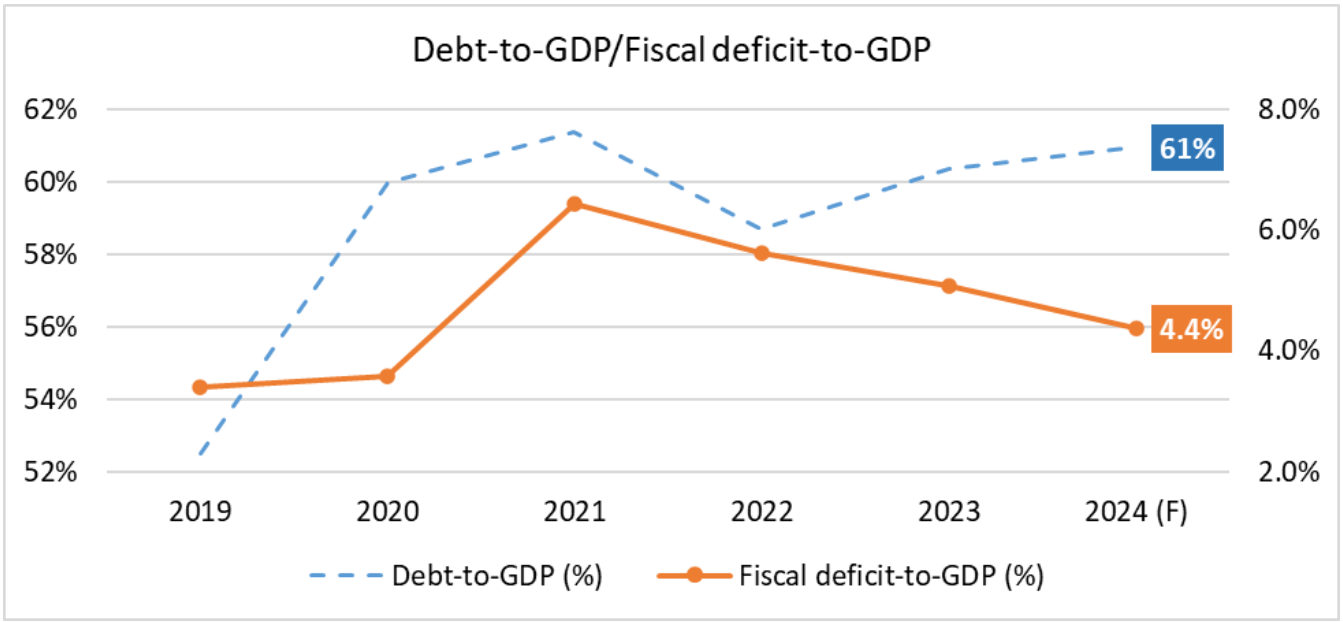

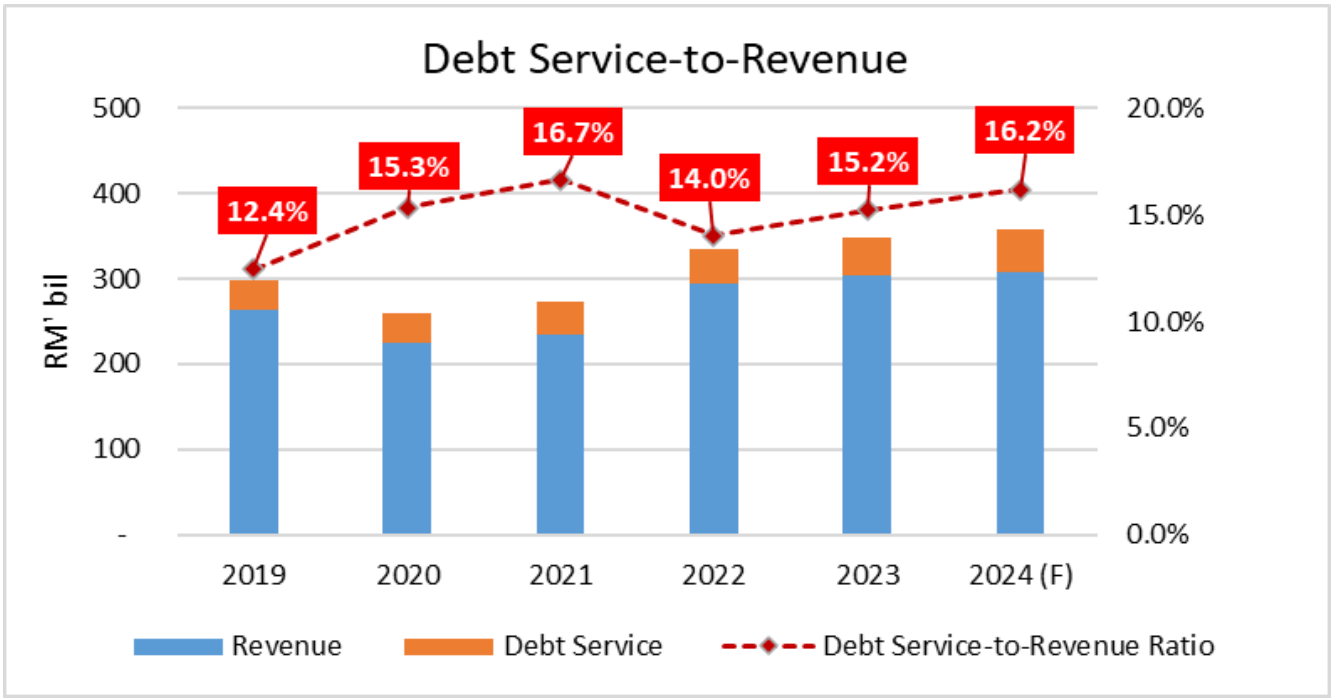

- Debt-to-GDP elevated above the 60% level; fiscal deficit-to-GDP improving albeit slower than projected. Debt-to-GDP is projected at 61% in 2024 due to unprecedented borrowings since the pandemic. Nevertheless, subsidy rationalization should support the current improvement in fiscal deficit-to-GDP. Achieving the 3.0% – 3.5% target would require fiscal deficits to fall towards the RM60-70bil level (compared to RM80-90bil previously). Furthermore, debt service charges have risen in tandem with Malaysia’s higher debt pile (2019: RM764bil; 2024 (F): RM1.2 tril) from debt-financed fiscal deficits, with 16.2% of revenue collected in 2024 earmarked for debt servicing alone.

Figure 2: Fiscal deficit-to-GDP ratio to improve albeit slowly due to government spending.

Source: Bloomberg, Ministry of Finance, Opus Asset Management

Figure 3: Debt service-to-revenue* ratio continues to rise.

Source: Ministry of Finance, Opus Asset Management

*Note: Debt service refers to interest payments on conventional debt and profit payments on sukuk.

- Fixed income market response to Budget 2024 was muted; investors more focused on geopolitical tensions and US volatility. The fixed income market response to Budget 2024 has been muted, given that borrowing levels are still elevated at the same levels. The lukewarm response was also understandable when taking into context the barrage of economic announcements from the Malaysian government over the past quarter (New Industrial Master Plan 2030, National Energy Transition etc). Nonetheless, Malaysian Government Securities (MGS) yields have taken cues from US Treasuries (USTs) which have been volatile in recent weeks due to evolving inflation expectations, as well as geopolitical tensions in the Middle East.

Our View – Slowly but surely:

- The overall 2024 budget is moving in the right direction where steps are taking to increase revenue by increasing new taxes, and steps taken to reduce subsidies. However, with the government prioritizing high cost of living especially to the B40, much of the cost savings are channeled to increase in cash handouts. Meanwhile, businesses and global growth are going to be impacted by high interest rates, thus posing challenges to GDP growth, which is forecast to grow 4% – 5%. Hence, we feel there are risk in bringing down our deficit level to 4.3% in 2024 and 3.5% in 2025.

- Government bond supply is envisaged to remain elevated, but we expect the market to be able to absorb the additional supply on the back of lower supply of corporate bonds as well as fund flows from riskier assets into the bond market. With higher yields, we see opportunity to lock in bonds at higher yields, focusing on high quality corporate bonds with moderate duration of 3 – 6 years

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.