- Budget 2025 sees higher expenditure featuring moderate fiscal consolidation.

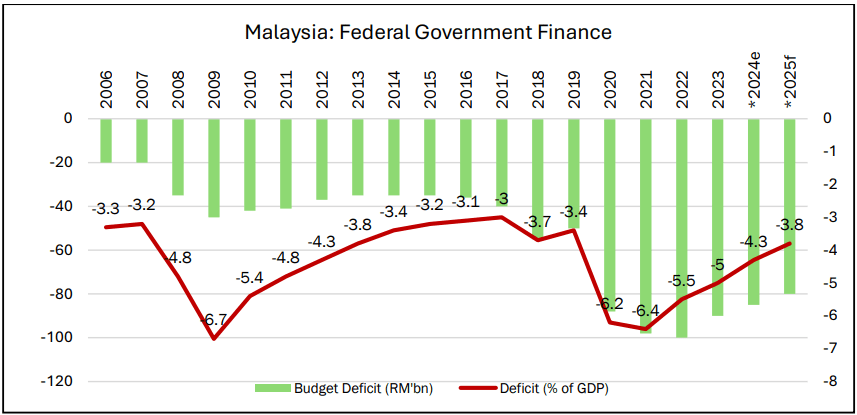

The Malaysian government projects a narrowing fiscal deficit to RM80.0 billion (3.8% of GDP) in 2025, down from RM84.3 billion (4.3%) in 2024, driven by higher revenue outpacing increased operating expenditure. Long-term fiscal consolidation remains a priority, with the deficit expected to further decrease to 3.5% of GDP under the Medium-Term Fiscal Framework (MTFF) 2025-2027, based on 4.9% average GDP growth and $80/barrel oil price assumptions.

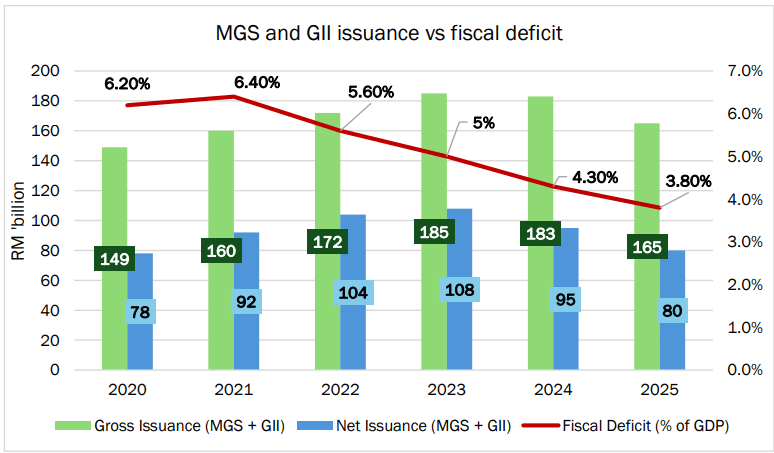

Figure 1: Fiscal deficit expected to narrow to 3.8% of GDP (Source: MOF Fiscal Report and Revenue Estimate Report 2025)

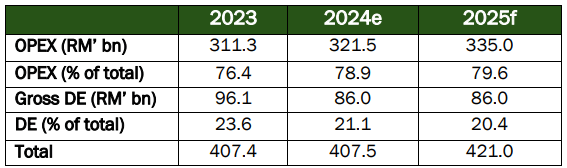

- Budget 2025 allocates RM421.0 billion (20.2% of GDP), with RM335.0 billion (79.6%) for operating expenditure (OE) and RM86.0 billion for development expenditure (DE). The budget prioritizes economic growth and public welfare, focusing on the Ministries of Education, Health, and Defense. Emoluments comprise 31.6% of OE, increasing by 6.2% year-on-year, while retirement charges (12% of OE) rise by 17.7%. Subsidies and social assistance are reduced by 14.4% to RM52.6 billion, accounting for 15.7% of OE compared to 19.1% in 2024, due to targeted subsidy rationalization for electricity and fuel. The 2024 subsidy allocation has been revised upward from RM52.8 billion to RM61.4 billion.

- The allocation for gross development expenditure (DE) remains steady at RM86.0 billion, representing 4.1% of GDP. The economic sector receives the largest share at 46.5%, though this is a 3.4% y-o-y decrease to RM40.0 billion. The focus is on enhancing national competitiveness through essential infrastructure and investment support. Key allocations include the environment, trade and industry, and transport sectors, with an emphasis on improving rural connectivity and easing congestion in urban areas. Notable new projects include a bridge and road from Ng Belawai to Song- Kapit in Sarawak and an additional lane for the Lebuhraya Selatan from Yong Peng to Senai Utara. Ongoing projects include the Pan Borneo Highway Sabah and the Sabah-Sarawak Ring Roads.

Table 1: Higher overall spending due to higher operating expenditure (Source: MOF Fiscal Outlook)

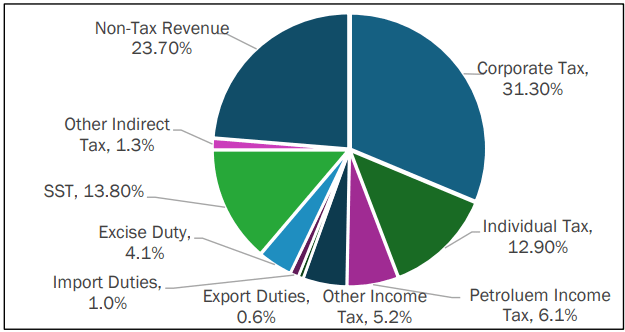

- The Malaysian government anticipates revenue to escalate to RM339.7 billion in 2025, marking a significant growth acceleration to 5.5% year-on-year from the previous 2.3%. Tax revenue remains the predominant source, constituting 76.3% of total revenue, propelled by increased earnings from stamp duties and Real Property Gains Tax (RPGT) due to a revitalized real estate market. Additionally, Companies Income Tax (CITA) will contribute significantly, with a 31.4% share and an 8.1% year-on-year increase, driven by a robust economic outlook and the phased introduction of e-invoicing.

- Income tax, comprising 12.9% of total revenue, is projected to grow steadily at 7.8% year-on-year, supported by a stable labor market and higher wages bringing more civil servants into taxable brackets. Conversely, Petroleum Income Tax (PITA) is expected to decline by 4.6% to RM20.7 billion due to lower oil prices. In the direct tax domain, Sales and Service Tax (SST), accounting for 13.8% of total revenue, is anticipated to rise by 14.2% y-o-y with the full implementation of the service tax. On the non-tax revenue front, dividends from Petronas are expected to remain stable at RM32 billion, while contributions from Bank Negara Malaysia (BNM), Khazanah Nasional Bhd, and the Retirement Fund (KWAP) are projected at RM4 billion, RM2 billion, and RM4 billion respectively, partially financing retirement charges.

Figure 2: Share of corporate and individual income taxes continued dominating (Source: MOF)

- The overall budget impact on the Malaysian Ringgit is considered neutral. The MYR has performed well this year, appreciating against the US Dollar (USD) and other G10 and major regional currencies. While the USD/MYR rate dropped to as low as 4.09 in late September, it has recently increased to around 4.30 due to a strengthening USD. The favorable growth outlook and advancements in reducing the fiscal deficit bode well for the MYR. However, concerns may arise regarding long-term fiscal and debt sustainability due to the slow pace of fiscal consolidation, despite strong growth this year. We anticipate the USD/MYR exchange rate to average around 4.25 until the end of the year, as the recent upward correction in the USD may have peaked, with expectations of renewed pressure on the dollar as year-end approaches. Looking ahead to next year, we maintain a positive outlook for the MYR, expecting gradual appreciation.

- The fiscal year 2025 is expected to see a lighter issuance of government securities as Malaysia targets a reduced fiscal deficit of approximately RM80 billion. This deficit will primarily be financed through onshore borrowings, specifically via Malaysian Government Securities (MGS) and Government Investment Issues (GII). We forecast the net issuance of MGS and GII to be RM80 billion, with gross issuance projected at RM165.0 billion. This includes refinancing maturing MGS and GII totaling RM83.5 billion. The anticipated net issuance for 2025 is lower than the RM95.4 billion issued in 2024, and the gross issuance is expected to decrease from 2024’s estimate of RM183 billion. This suggests a more favorable demand-supply dynamic for the MGS and GII market in 2025. However, any increase in net issuance could arise from unexpected expenditure hikes, such as a surge in global crude oil prices affecting subsidy costs.

- Overall, the 2025 budget is marginally positive for bonds considering the expected reduction in bond supply. Based on the scheduled MGS/GII maturities, the bulk of maturities in 2025 take place between the August to October period, so net supply is likely to be sizeable for 1H 2025 before the supply dynamics improve in 2H 2025. The Government’s funding will continue to be sourced onshore despite the availability of spare limits for the issuance of foreign currency bonds (FCY). There are no scheduled FCY sovereign bond/Sukuk maturities in 2025.

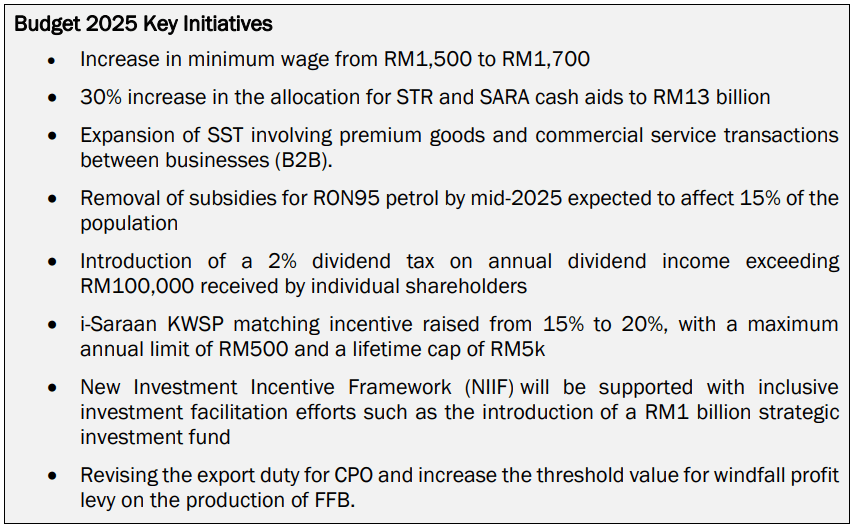

Figure 3: Fiscal year 2025 is anticipated to be more constructive regarding demand vs supply for

the MGS and GII market (Source: MOF, BNM)

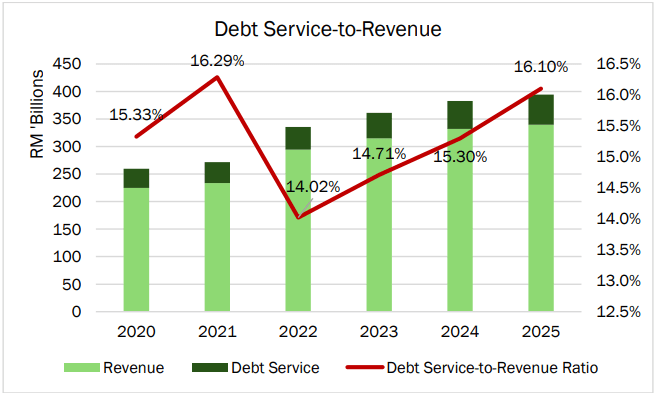

- The government’s debt service charges warrant careful examination. These charges have risen from RM38.1 billion in FY2021 to an estimated RM50.1 billion for FY2024, with projections reaching RM54.7 billion in FY2025. When assessed against a common metric like government revenue, the debt service charge as a percentage of revenue was 16.3% in FY2021, decreased to 15.8% in FY2024, and is expected to increase to 16.1% in the upcoming fiscal year. This ratio is notably scrutinized by international rating agencies, as a level of 15% or below is typically seen as the threshold for maintaining an A3/A-country rating, which is Malaysia’s current rating by Moody’s and S&P.

Figure 4: Debt service-to-revenue* ratio continues to rise

Source: Ministry of Finance, Opus Asset Management

*Note: Debt service refers to interest payments on conventional debt and profit payments on sukuk.

Cautious Optimism – Our take on Malaysia’s Budget 2025

- We think that Malaysia’s Budget 2025 presents a cautiously optimistic outlook for the nation’s fiscal and economic future. The substantial RM421 billion budget signifies a strategic effort to balance fiscal sustainability with economic growth. We appreciate the government’s commitment to reducing the fiscal deficit to 3.8% of GDP, alongside targeted subsidy reforms and an expanded tax base, as these measures reflect prudent fiscal management aimed at enhancing revenue collection and ensuring long-term debt sustainability—factors that are favorable for fixed income investments.

- We anticipate that the projected economic growth rate of 4.5% to 5.5% in 2025, supported by ongoing public investment in infrastructure and social welfare, will create a supportive environment for economic expansion. However, we are mindful that the pace of fiscal consolidation could raise concerns about investor confidence in Malaysia’s fiscal discipline over the long term. Despite these challenges, we believe that the government’s focus on boosting competitiveness through high-tech investments and addressing social welfare needs will foster a stable macroeconomic environment, benefiting bond markets. With a steady supply of issuances in the market amidst a strong economic outlook, we would take opportunities in high quality corporate bonds with attractive spreads to enhance our carry returns.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.