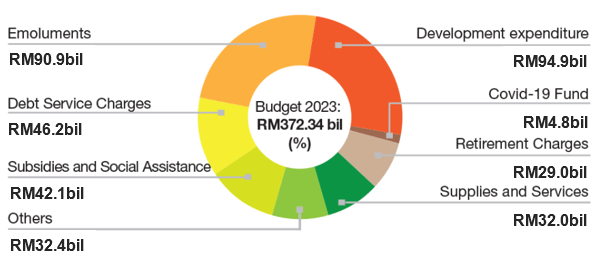

- Budget 2023 expenditure only marginally lower than Budget 2022, with total expenditure of RM372.3bil (Budget 2022 (revised)[1]; RM385.3bil), which is consistent with expectations of an expansionary budget that maintains higher spending on subsidies and civil servant emoluments. The expansionary budget is in line with the need to maintain GDP growth momentum in light of heightening global economic risks, alongside expectations of an upcoming election.

- Bulk of rise in expenditure due to significantly higher RM95bil Development Expenditure (DE) allocation in Budget 2023 (Budget 2022 DE: RM71.8bil) as seen in Figure 1. A key beneficiary is the road infrastructure sector, for mega-projects such as the Trans-Borneo Highway; Sarawak Sabah Link Road Phase 2; Pengalat-Papar bypass road in Sabah; and upgrading of the Pasir Gudang Highway. The single largest project was for MRT3, with an allocation of RM50.2bil.

Figure 1: Budget 2023 expenditure elevated due to larger development expenditure spend.

Source: The Edge, Opus Asset Management

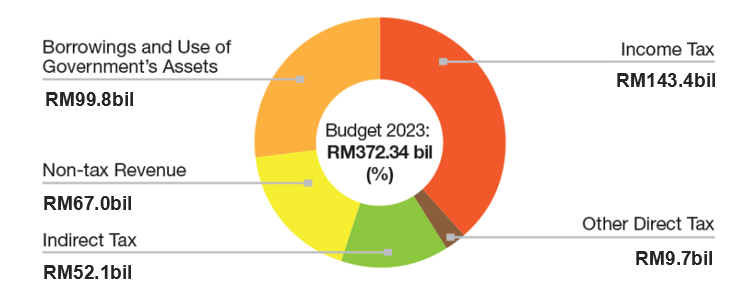

- Government revenues to decline for 2023 to RM272.6bil (2022; RM285.2bil) due to lower non-tax revenue and removal of one-off Prosperity Tax (Cukai Makmur). Slower forecasted economic growth in 2023 (4% – 5%), moderating commodity prices and a lowered expectation of Petronas’ dividend of RM35bil in 2023 (2022: RM50bil inclusive of special dividend) were cited by the Government of Malaysia as reasons for a lower revenue forecast for Budget 2023, with the deficit to be financed by borrowings as seen in Figure 2.

Figure 2: Budget 2023 revenue shortfall to be met by borrowings.

Source: The Edge, Opus Asset Management

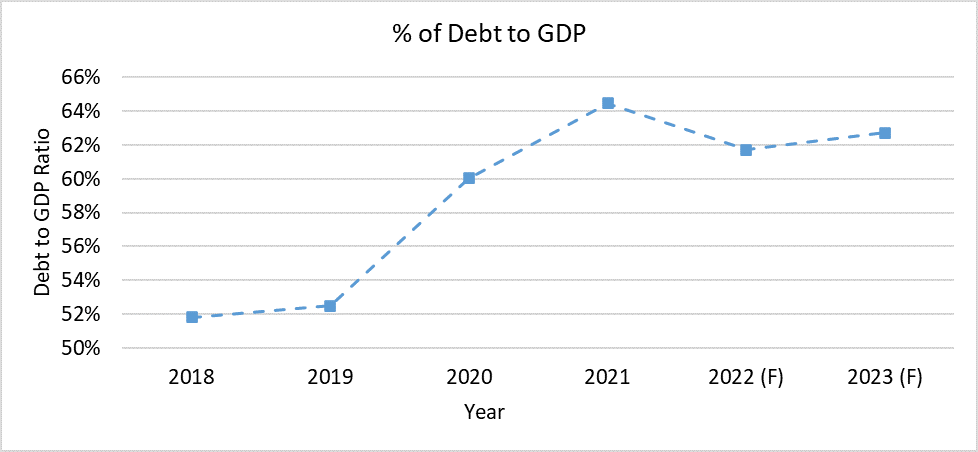

- Fiscal deficit-to-GDP ratio expected to decrease to 5.5% in 2023 (2022: 5.8%) but remains above 5% fiscal consolidation target. We note that despite a reduction in the fiscal deficit-to-GDP ratio, Malaysia’s absolute fiscal deficit remains roughly the same (2023: RM99.07bil; 2022: RM99.48bil). We view this as the Malaysian government maintaining its spending in view of Budget 2023’s status as an “election-year” budget, thereby putting off significant fiscal consolidation to beyond 2023. To this end, our forecasts also see another slight increase in the debt-to-GDP ratio (2022: 61%; 2023: 62%).

- Economic recovery to continue, but slowdown expected. Malaysia’s forecasted economic growth of 4% – 5% in 2023 takes into consideration weaker prospects for global economic growth, with advanced economies such as the Eurozone and US at major risk of recession. Thus, trade-focused economies like Malaysia are expected to be affected by the spillover in slower global growth which would reduce trade volumes.

- Headline inflation seen at 2.8% – 3.3% for 2023 (2022F: 2.2% – 3.3). Stabilisation in growth will reflect in a lower unemployment rate that is forecast to trend down to 3.5% – 3.7% in 2022 (2022F: 3.8%-4.0%) on the back of fading pandemic effects.

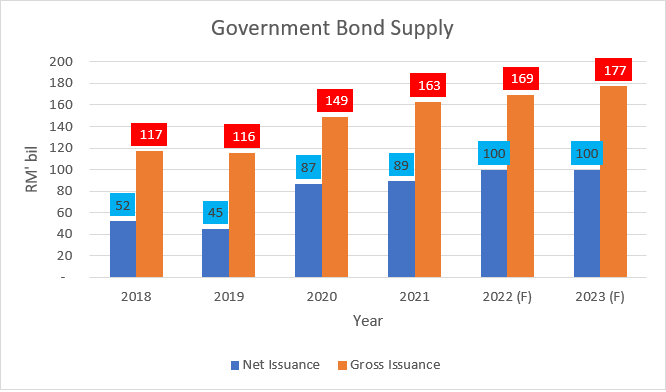

Opus’s opinion:

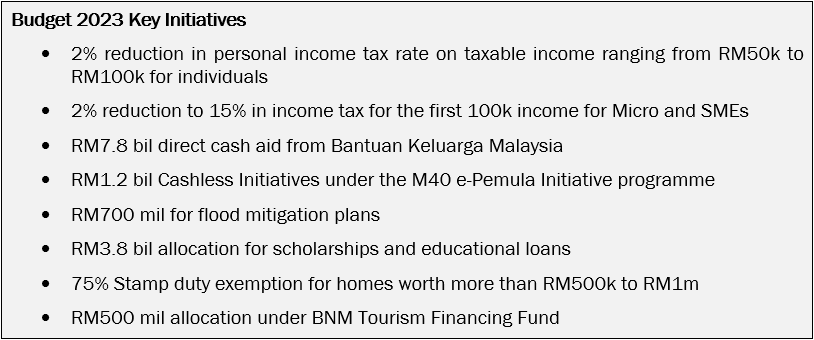

- Government bond supply to remain elevated at RM175bil range for 2023 due to higher maturities. We expect the Malaysian government bond (MGS and GII) supply to trend upwards as depicted in Figure 3. Apart from the higher government bond supply, government guaranteed issuances and government related entities’ issuances are expected to increase in tandem with the higher allocation towards mega-projects under Development Expenditure.

Figure 3: Gross and net government bond supply to remain elevated in 2023.

Source: Bloomberg, Ministry of Finance, Opus Asset Management

- Better GDP growth prospects saw Debt-to-GDP decline below debt ceiling. Debt-to-GDP has declined from its high near the statutory debt ceiling of 65%, although current levels remain above 60%. Fiscal consolidation in the form of subsidy rationalization (e.g. targeted subsidy mechanism) may support a continuing decline of the Debt-to-GDP ratio over time. We expect this to gain better traction after 2023, following the General Election.

Figure 4: Debt-to-GDP ratio still elevated with minimal change in 2023.

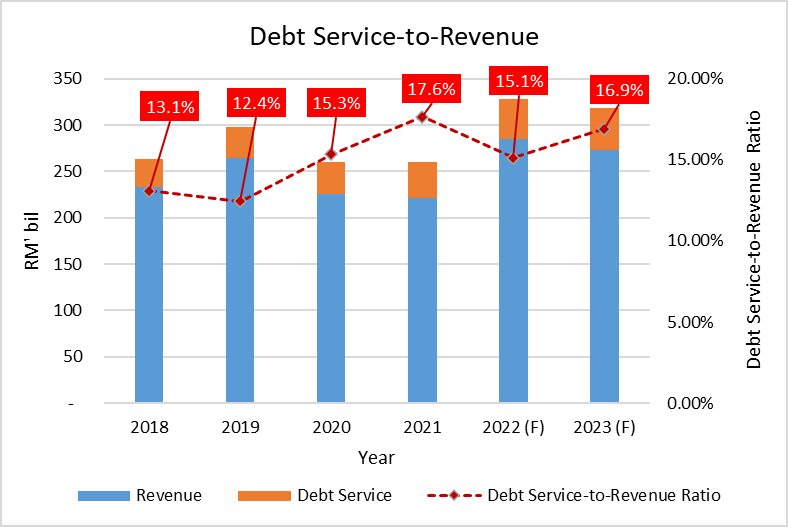

- Sovereign rating likely to remain stable on medium term consolidation plan. Standard & Poor’s previously revised Malaysia’s sovereign outlook to stable from negative, citing a strong economic recovery in 2022, among various factors. The previous negative outlook was due to the deterioration in fiscal metrics such as the Debt-to-GDP ratio, fiscal deficit-to-GDP ratio and debt service-to-revenue ratio during the pandemic as seen in Figures 3, 4 and 5. However, we note that despite slight improvements elsewhere, the elevated levels of the said ratios could cap a potential upgrade for Malaysia’s sovereign rating. As such, Malaysia’s sovereign rating is likely to remain unchanged even with the government’s target average deficit ratio of 4.4% of GDP over 2023-2025. Of note, this consolidation may be supported by the targeted subsidy mechanism (i.e. for petrol) and potential for an eventual re-enactment of GST (Goods and Services Tax), resulting in higher inflation.

Figure 5: Debt service-to-revenue ratio* continues to rise.

Source: Ministry of Finance, Opus Asset Management

*Note: Debt service refers to interest payments on conventional debt and profit payments on sukuk.

- Malaysia’s debt consolidation still on the back burner. Malaysia’s mild fiscal consolidation is largely possible due to the strong economic recovery post-pandemic. However, this also implies that fiscal improvement is fragile due to headwinds caused by a global economic slowdown and coordinated global monetary tightening. Nonetheless, the need for an expansionary budget in 2023 is understandable given the aforementioned global economic headwinds and typically higher spending during election years.

[1] Budget 2022’s expenditure was revised upwards to RM385.3bil due to higher than expected allocation required for subsidies e.g. petrol, basic foodstuffs and controlled goods.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.