By Opus Asset Management Sdn Bhd

- Federal Funds Rate raised by 75 basis points (bps) to 1.75%. On Wednesday, the US Federal Reserve (Fed) raised the Fed funds rate by 75bps to 1.50%-1.75%. We note that the outsized 75bps rate hike can partly be attributed to last Friday’s higher-than-expected May Consumer Price Index (CPI) numbers (+8.6% Year-on-Year (YoY)). Also notable is that the Federal Reserve had previously guided that rate hikes would be in the region of 50bps, which resulted in the rate increase of 75bps being above the Bloomberg consensus of 50bps.

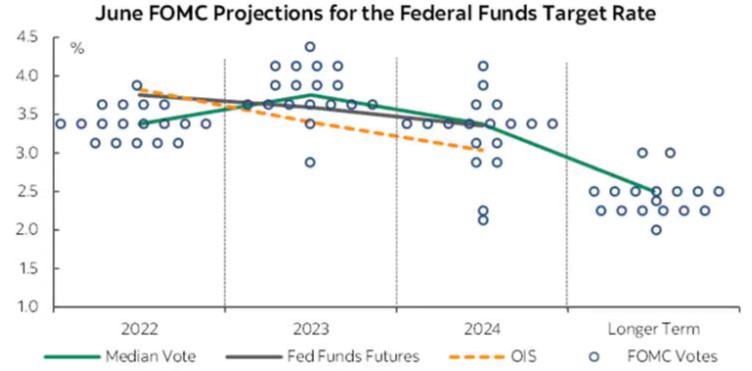

- Updated Fed dot plot reveals potentially another 175bps in rate hikes. The new median Fed funds rate expectation by the Fed’s policy committee members is now 3.4%, which leaves another 175bps of potential rate hikes spread over four remaining meetings. Similarly, the FOMC also updated its inflation forecasts, with the Personal Consumption Expenditures (PCE) Index seen to rise above 5.0% in Q422 (Mar’22 projection: above 4.0%). The GDP growth outlook for the US is also projected to be dimmer at between 1.6% to 1.7% for 2022, compared to above 2.5% previously in March.

Source: Bloomberg, Bank of Nova Scotia

- High Consumer Price Index (CPI) in May driven by housing and rent costs, which may persist for a while. The May CPI numbers of +8.6% (Apr’22: +8.3%) shows that inflation remains stubbornly high. While house prices may head lower as a result of higher Fed Funds rate (and thus mortgage rates), housing costs could remain high as housing rent, which holds 1/3 weighting in the CPI basket, typically lags house prices. As such, we opine that the impact on CPI could be delayed, thus US CPI numbers may remain elevated for some time. In light of stubborn inflation, Fed chair Jerome Powell had also guided that the next July meeting could see either a 50bps or 75bps hike.

- Recession fears as Fed attempts to navigate a “soft landing”. Despite the lowering of GDP growth forecasts, the Fed noted that economic activity “appears to have picked up after edging down in the first quarter”, while Jerome Powell continues to claim that a “soft landing” remains achievable. In our view, volatile commodity prices from the ongoing Russia-Ukraine war and the threat of supply chain disruptions from China’s zero-COVID policy are headwinds to global economic prospects. The current probability of a US recession within the next 12 months continues to tick up with the probability now at more than 30%.

- MGS markets recovered slightly following Fed decision given rising growth risks. Thanks to the implicit management of investor expectations by the Fed following the high CPI data release last Friday, the US yield curve responded to Wednesday’s news of the 75bps rate hike by sliding lower. The UST 2Y and 10Y was lower at roughly 3.19% and 3.28% respectively. Similarly, MGS yields were slightly lower following the Fed meeting. Investors had already priced in a more hawkish Fed following last Friday’s CPI release with the benchmark 10Y MGS rising ~20bps in response. In this regard, the latest Fed decision is unlikely to lead to excessive bond market volatility in Malaysia. Furthermore, rising risks of a global recession and a slowdown in growth caused by further rate hike could lead to a cap on bond yields.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.