By Opus Asset Management Sdn Bhd

- Federal Funds Rate raised by 25bps to 0.5%. The US Federal Reserve (Fed) increased the Fed funds rate by 25bps to the 0.25%-0.50% range, avoiding a larger hike due to concerns that the Russia-Ukraine war will weigh on economic activity. The Federal Reserve’s action can be interpreted as preferring not to spook financial markets.

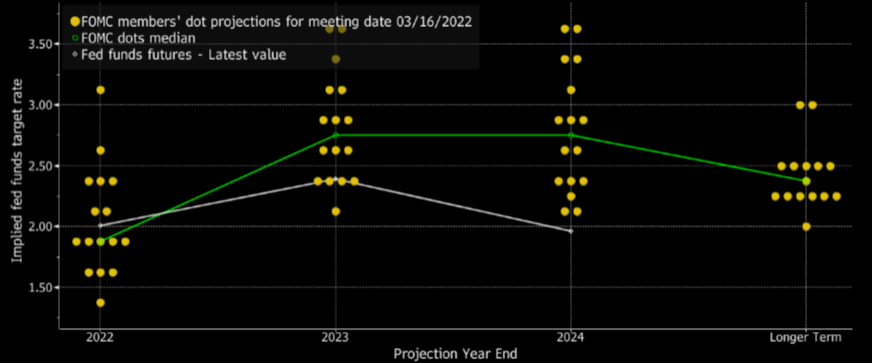

- Fed guides more rate hikes and potential balance sheet reduction by May in view of hot inflation (Feb: +7.9% YoY). The Federal Reserve is expected to finalize the details of the balance sheet reduction by May, with its parameters to be revealed in their minutes in three weeks time. The Federal Reserve and the futures markets are both expecting around 6 more rate hikes to 2.00% by end-2022. At Opus, we believe that there may be fewer rate hikes than the present expectation due to rising risks of economic instability from a tense global geopolitical situation. Furthermore, unusually high inflation will dampen consumer sentiment and hamper commercial investment decisions.

- Russia-Ukraine war raises inflation risk. Elevated US inflation numbers, driven by sky-high energy and commodities prices from the current conflict in Ukraine has forced the Fed to forecast a higher inflation rate for 2022 (4.3%), underpinning its stance to raise interest rates aggressively this year. Prior to the rise in oil price which is now hovering near $100/barrel, inflation in the US was already near 8%, and is expected to continue rising in the near term.

- Growth concerns remain. Conversely, US growth prospects in 2022 were revised downwards to 2.8% (Dec’21: 4.0%), although Powell did seek to comfort markets by emphasizing the resilience of the US economy, backed by a strong labour market. Economic uncertainties caused by global geopolitical tensions, concerns over higher funding costs and supply chain disruptions will continue to weigh on the growth outlook. As investors mulled the reduced growth prospects presented by the Fed, yields on the 10Y UST declined to 2.13% compared to last week’s peak of 2.20%.

Figure 1: Federal Open Market Committee (FOMC) dot plot projections rose significantly compared to previous projection in Dec’21 due to persistent inflation in Jan’22 and Feb’22

Source: Bloomberg

- The Malaysian Government Securities (MGS) yield curve was quite calm despite concerns on additional EPF withdrawal scheme and volatile UST movements. Of note, it was announced that the Employee’s Provident Fund (EPF) members would be allowed to have a one-time withdrawal of up to RM10,000, available for application in the month of April 2022. The EPF believes that this additional withdrawal would be the last, given an improving employment situation and cautioned that such withdrawals would affect retirement adequacy. In 2021, a gross amount of RM101bn was withdrawn, leading to a net withdrawal of RM58bn. As such, we estimate that this latest withdrawal could be less than half of the amount in 2021 and therefore not cause a net withdrawal in 2022. Furthermore, the withdrawal will be limited since about half of EPF members have less than RM10,000.Despite the EPF withdrawal news coupled with the aggressive Federal Reserve, MGS yields reacted mildly, moving within a few basis points. Even before the buildup to the March Fed meeting, MGS yield changes were muted. The stability in MGS can be attributed to safe haven inflows since Malaysia is a commodities exporter and would benefit from the rise in commodities prices. Also, we note Malaysia’s policy rate does not move in lockstep with Fed policy and the Malaysian Ringgit has remained resilient, trading below 4.20 to the Dollar. Thus, despite more rate hikes by the Federal Reserve, our house view remains 1 rate hike of 25 bps for the Malaysian Overnight Policy Rate (OPR) in 2H22 as we remain cautious of ongoing risks to global growth.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.