1 May 2024

Federal Open Market Committee (FOMC)

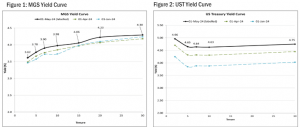

- The Federal Open Market Committee (FOMC) unanimously decided to maintain the Fed Funds Rate (FFR) at 5.25% – 5.50%, in line with broad market consensus. The decision saw the US Treasury (UST) yields falling between 3 – 7 bps across the curve, as UST2Y closed 7bps lower at 4.96% and UST10Y closed 5bps lower at 4.63%.

- The May Monetary Policy Statement (MPS) and press conference suggest that the US Federal Reserve (Fed) continue to maintain their easing bias but continued to espouse the message of patience that rates may stay elevated for longer. The May MPS saw the addition of the line, ‘in recent months, there has been a lack of further progress toward the Committee’s 2.00% inflation objective’, reflecting the stickier than expected inflation in 1Q2024. May’s MPS continued to emphasise that the FOMC ‘does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably towards 2.00%’. This notwithstanding, during the press conference FOMC Chair Powell, signalled that rate hikes are unlikely as the Feb believes that over time the current level of interest rates will prove to be ‘sufficiently restrictive’.

- The Fed also announced that they will significantly slow down the quantitative tightening (QT) program reducing the rate of QT by cutting the monthly reduction cap on UST from US$60 billion to US$25 billion, while maintaining the monthly reduction cap of mortgage back securities (MBS) unchanged at US$35 billion starting 1 Jun’24. The slower pace of QT will ensure that the Fed can shrink the balance sheet without causing undue stress in the financial markets.

Opus View

- UST has fully priced in a 25-bps rate cut. While the UST has started to reprise the delayed and smaller rate cuts in the last 2 months, the MGS market has only started to move in the month of April. However, we feel that the big adjustment in the UST is done, with market now pricing only 25 bps rate cut. While we do not discount the possibility of no rate cut in 2024, and there may still be some volatility, the risk is now lower.

- Opportunity to invest at higher yield. MGS yields have gone up by 10 – 15 bps during the month. With OPR maintaining at 3.0% and continued support from local institutions, we see opportunity to invest in higher yields.

- Narrative of rate cuts supportive of bond market. While the timing and the quantum of rate cuts in 2024 is still debatable and data dependent, the narrative of rate cuts commencing is supportive of the local bond market and the MYR as the yield differentials will narrow.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.