Malaysia 1Q24 GDP Review

May 2024

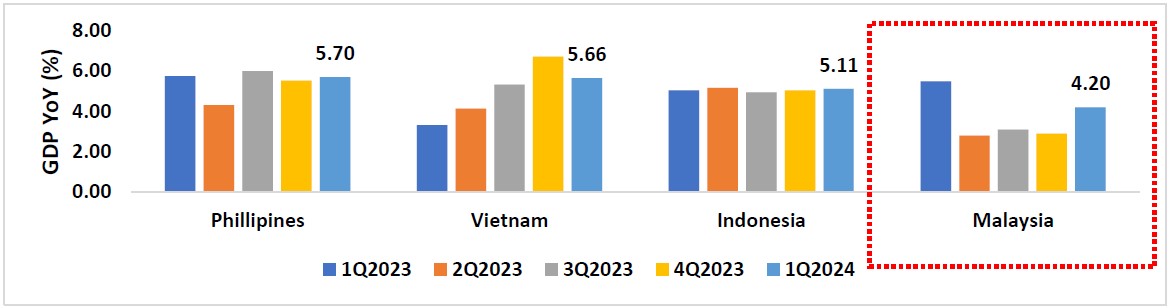

- Malaysia’s 1Q2024 Gross Domestic Product (GDP) rose by 4.2% YoY (4Q23: 2.9% YoY). The final print surpassed the advanced estimates (3.9% YoY) released in the prior month, largely driven by strong private consumption, improvement in investment activities and smaller drag from exports. We also saw similarly strong growth across the regional peers, led by the Philippines growing by +5.70% YoY, Vietnam by +5.66% YoY and Indonesia by +5.11% YoY.

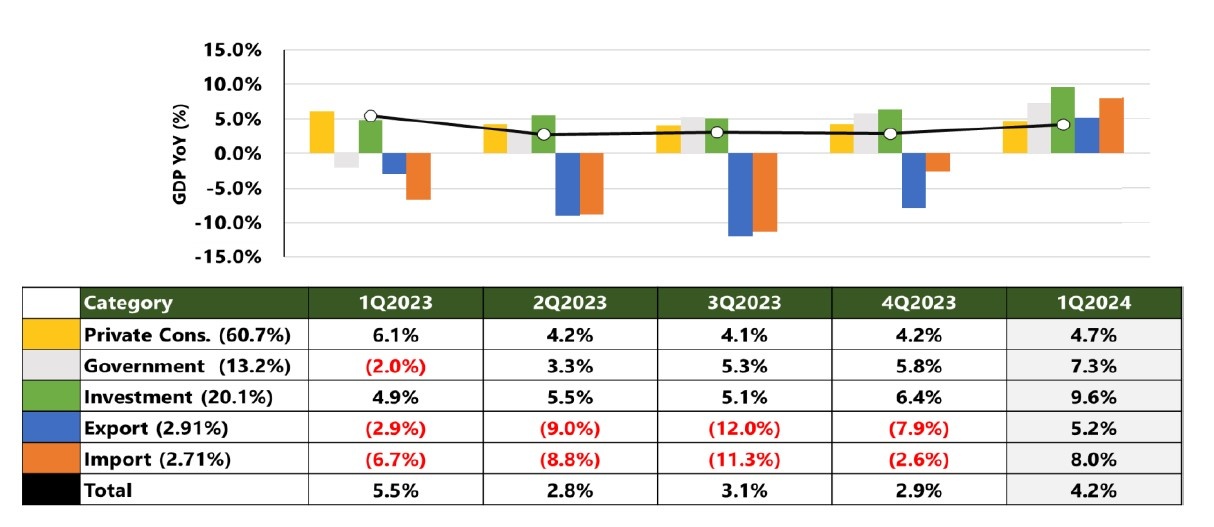

- Domestic demand remains key to sustaining the country’s GDP growth; whilst recovery of external trade will provide additional support towards economic growth. Domestic demand grew by 6.1% YoY (4Q2023: 4.9%), amidst stronger growth across the board with private consumption growing by 4.7% (4Q2023: 4.2%), government spending by 7.3% (4Q2023: 5.8%), and investment by 9.6% (4Q2023: 6.4%). Imports and exports turned positive for the first time in a year after four consecutive quarters of decline, growing by 5.2% and 8.0%. The improvements in exports were in line with the recovery of the electrical and electronics (E&E) segment and higher commodity prices, whilst the improved imports were mainly driven by the higher imports of intermediate goods as manufacturing activities started to pick up during the quarter.

- Domestic demand will continue to be supported by the robust labor market conditions, active progress in multi-year infrastructure projects, and the recovery of the E&E and tourism segment. Malaysia’s unemployment remained low at 3.3% (4Q2023: 3.3%), and wages are expected to grow with the introduction of progressive wage project starting Jun’24 and a salary increment for civil servants in Dec’24. Additionally, the introduction of Employees Provident Fund (EPF) account 3 in May’24, which is anticipated to facilitate withdrawal worth RM20 – RM30 billion will further strengthen private consumption. Investments activities are also expected to be well supported by increased foreign interest in the country’s integrated circuit (IC) design parks, data centers and renewable energy projects. The continued progress of the government’s multi-year infrastructure projects such as the East Coast Rail Link (ECRL), Rapid Transit System (RTS), MyDigital 5G and Pan Borneo highway, will further bolster economic growth.

Opus View:

- Going forward, the growth of the Malaysian economy will continue to be driven by the resilient domestic demand. Household spending will continue to be supported by the strong labour market and steady employment and wage growth. Additionally, the progress of multi-year infrastructure projects, implementation of new government initiatives and recovery of the E&E segment will be the growth catalysts moving forward. We expect 2024 GDP growth to be higher than 4.5%, within the projection of 4% – 5%.

- Headline and core inflation remains subdued. Headline and core inflation remains subdued at 1.8% (Prior: 1.8%) and 1.7% (Prior: 1.8%) in Mar’24. Subsidy rationalization and removal of price controls continues to pose risk towards the upside, but the magnitude will depend on the pace of implementation by our government notwithstanding any global price volatility risk.

- BNM will maintain OPR at 3.00% for the remainder of the year. In May’s monetary policy committee (MPC) meeting, BNM stated that the current monetary stance remains supportive of the economy and is consistent with the central bank’s assessment of inflation and growth prospects, which somewhat dismissed any possibility of a rate hike. However, with global rates expected to remain high for longer, we expect OPR to also remain at 3.00% for an extended period.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.