In an environment of rising interest rates, an important question investors may have is: what is Malaysia’s expected long-term normalised interest rate?

To answer this question, we need to have a view of key variables, such as Malaysia’s long-term expectation of GDP growth, unemployment and inflation. These variables can assist in arriving at a figure approximating Malaysia’s long-term normalised interest rate via a modified Taylors’ rule model. While this model is sometimes criticised as having a narrow scope, it is also praised for its model parsimony and fits our requirements. In any case, the modified version of the Taylor’s rule model can be modified to take into account persistence of structural accommodation or policy tightness and qualitative expectations of secular changes in these variables, as we shall discuss.

Long term GDP growth trend

Based on the longest available data from the IMF, the 1980 to 2022 average GDP growth rate of Malaysia was approximately 5.50%. In line with the ongoing recovery, the forecast average GDP growth rate from 2023 to 2027 is seen at 4.62%. This is a marked upshift compared to the average growth rate of 2.46% in the preceding 5 years, which was of course low due to the global pandemic.

The effect of the lower forecast on GDP growth in the next 5 years (as compared to the 1980 -2022 average) suggests that interest rates going forward would not have to be as high as compared to the long-term average to accommodate a lower growth economy.

The reasons for the weaker GDP growth outlook are due to several factors that reflect the maturity of the economy, part of a natural long-term cycle. For example, aging demographics will adversely affect the propensity to consume. Young working adults tend to have a faster rate of asset accumulation due to needs such as buying a car and house. Over time, a more mature economy will have a larger proportion of the services sector and by extension, a smaller share in manufacturing and exports which in turn leads to lower growth. This means a relatively smaller portion of the tradeable goods sector and therefore a relatively smaller exports market. The traded goods sector of course, benefits from both the domestic and foreign markets and therefore, has a tendency to contribute more significantly to GDP growth. This is evidenced by Malaysia’s smaller current account balance-to-GDP ratio, which used to be in the teens and is now in the low single digits. Also, a mature economy usually has a higher GDP per capita and consumption upon reaching a certain level will face diminishing future growth rates. This is due to the mathematical base effect (i.e. at a higher level of GDP per capita, the absolute increase must be much larger to maintain the same relative growth rate) and the saturation of consumption means a declining marginal propensity to consume in the future.

Structural shifts in unemployment

Continuing the above narrative, a structural shift from the tradeable goods sector to the services sector, and a similar shift from the contribution of the primary sectors (e.g. commodities production) to the tertiary sector (e.g. financial services), will also mean a shift in labour market patterns. The primary sector is usually more labour-intensive than the tertiary sector and therefore supports a lower unemployment rate. Tertiary sectors on the other hand, tend to employ a greater use of technology. Even so, accelerated adoption of technology caused by the pandemic is also finding its way into labour-reliant parts of the tertiary industry due to a newfound aversion to physical contact, such as payment checkouts without cashiers, e-commerce rather than shop-based commerce, and the use of drones for logistics services.

From 1985 to 2021, the average unemployment rate was 3.99%. In the five-year period of 2018 to 2022, this is seen to be 4.06%, while the IMF forecast for the subsequent five years of 2023 to 2027 is an average of 4.22%. From 1992 to 2019, the unemployment rate was even lower, at an average of 3.25%. These data support the idea that on a long-term trend basis, due to the abovementioned structural shifts in the economy, the unemployment rate will tend to rise.

As such, the implication of higher unemployment on interest rates is for an inclination toward easier monetary policy.

Inflation as a confounding variable

Today, more than ever, the war on inflation is gaining greater traction. The basic expectation is for monetary policy to turn tighter, through tools such as raising interest rates or the reversal of quantitative easing. However, the situation is rather complex, because inflation is caused by both cost-pushed and demand pulled factors. Cost-pushed factors arise from higher input costs, such as higher commodity prices caused by the Russia-Ukraine war. Such inflation factors are difficult to manage through monetary policy since interest rates cause a decline in consumption by raising the cost of borrowing. To a smaller extent, higher interest rates act to lower wealth (and therefore, some discretionary consumption) through a decline in the equity market and risky assets. This is the argument that has been used by central banks that were not too keen on increasing interest rates aggressively.

In the US case, where consumption demand is high and unemployment low, aggressive interest rate increases are expected. While this is applicable to the US economy, the unfortunate consequence is that higher interest rates in the US will transmit to high interest rates and bond yields in other countries that still suffer from sub-par growth. This includes countries such as Malaysia that continue to grapple with a fragile recovery. Therefore, even if Malaysia does not have to raise the interest rate much more, higher US interest rates will lead to escalating funding costs for corporations especially in the bond market. This is difficult to manage because the US-Malaysia interest rate differential has the effect of lowering growth as higher US interest rates transmit to financial markets, which is already being reflected in elevated Malaysian bond yields. This is even harder to manage considering that Malaysia does not have an inflation-related reason to raise interest rates. Through experience, Malaysia has managed inflation well, and the inflation rate for the five-year period of 2018 to 2022 is seen at a mere 1.22% on average. While Malaysia’s inflation rate is expected to rise, it is forecast by the IMF to average a very manageable 2.42% for the five-year period of 2023 to 2027.

Consequently, it remains a difficult-to-resolve debate if it is necessary and effective for Malaysia to raise the interest rate to help contain inflation.

Synthesis and conclusion: What should Malaysia’s long term interest rate be?

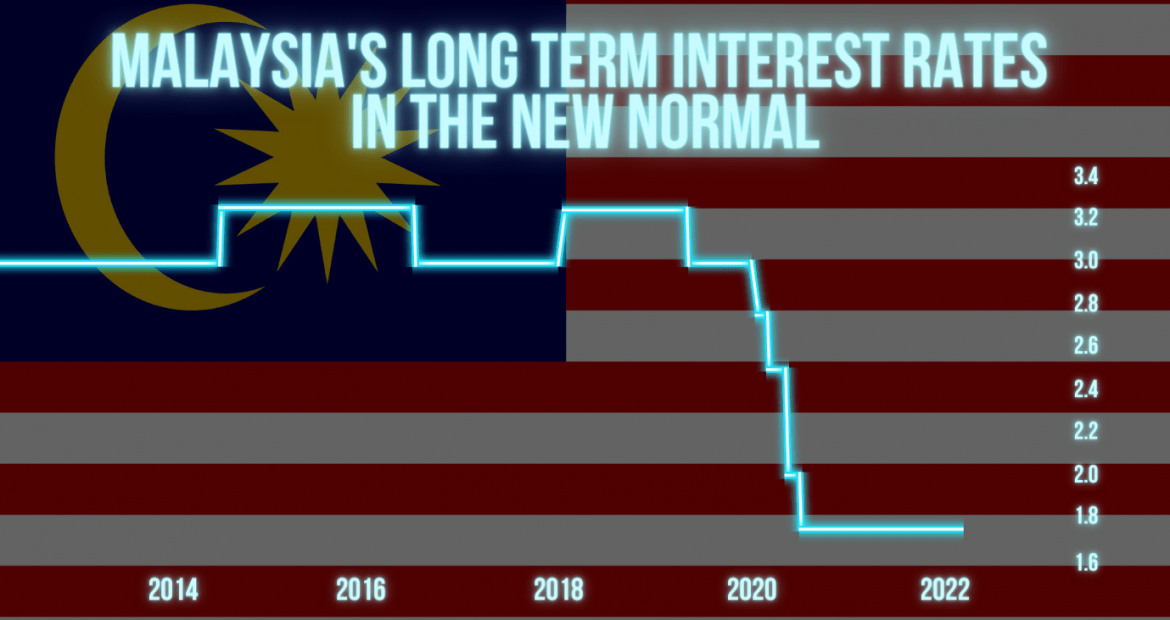

Based on the above discussion of long-term expectations on unemployment, inflation and growth, much needs to be done to help the economy grow and create jobs, and interest rates cannot be raised aggressively. Over the long term, a 3% interest rate can be said to be an approximate normalised interest rate level that is consistent with lowering the unemployment rate below 4%. A 3% interest rate would continue to help inflation and GDP rise at a comfortable pace, more in line with the long-term average.

Nonetheless, the normalisation in interest rates will not happen in one year, and a move from 1.75% to 3.00% can take several years to happen (and by that time, there is the likelihood of intermittent economic downdrafts, hampering interest rate normalisation). However, policies beyond interest rates will need to do the heavy lifting, as economic growth depends on total factor productivity, which is in turn dependent on the intensity and quality of capital input and investments, as well as the quality of human resources. Fiscal policy and the private sector will play an important role in the new norm, in an increasingly capital-intensive and technologised world.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.