- US Consumer Price Index (CPI) continues rising, while UK CPI increase remains elevated. US CPI grew +6.4% YoY in Jan’23 (Dec’22: +6.5% YoY), which disappointed market expectations of a decline to +6.2% YoY, while UK CPI growth still lingered above 10% (Dec’22: +10.3%; Jan’23: +10.1%). Compared to the inflationary peaks in 3Q22, the slight moderation in food and energy prices towards the end of 2022 resulted in lower inflation for developed economies. On the flip side, we remain aware of the stubbornness of services prices which will keep a floor under CPI growth at least in the near term.

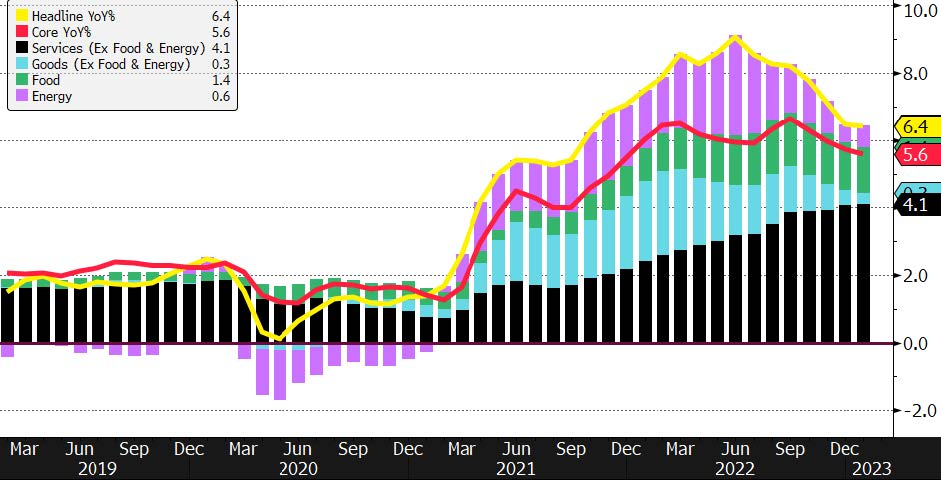

- Improvements in energy and goods prices mitigated by still-increasing services inflation. Figure 1 illustrates the continued rise in prices for services in the US despite gradual slowdowns in the goods and energy categories. We note that this reflects changing spending patterns as consumers increasingly substitute goods purchases with services expenditure post-COVID. Diving deeper into the services category, rising shelter costs (~34% of CPI weight) continued to weigh on substantial improvements on the overall CPI number although there are signs of improvement. However, research has shown that rent CPI tends to lag changes in other independent rental measures by 2-3 quarters. Thus, any meaningful decline in rent CPI and by extension the overall CPI should only materialise later into 2023.

Figure 1: Stubbornly high services prices continued to drive US CPI in Jan’23.

Source: Bloomberg

- US retail spending jumped after fading towards end-2022. Seasonally adjusted retail spending numbers rose 3% month-on-month in Jan’23, after previously declining in Nov’22 and Dec’22. Robust retail spending could also have been a beneficiary of the resilient labour market, as US workers continued to see wage increases with the US economy adding ~517k jobs in Jan’23. Taken together, the stubbornness of CPI and positive economic indicators (strong consumer spending and labour markets) has led to volatility in the fixed-income markets as participants repriced their expected Fed Funds terminal rate upwards.

- Global inflation outlook has moderated in recent months but remains far from respective central bank targets. Despite the improvements in inflation indicators towards end-2022, price levels (Dec’22 PCE: +5.0% YoY) are more than double of the Fed’s PCE target of +2.0% YoY, while Jan’23’s CPI disappointment is a reminder that inflation is still a substantial problem. Similarly, inflation in the UK and the Eurozone remain substantially higher than the 2% target of both central banks. In view of the above, we do not discount the possibility of further volatility and remain neutral as unfavourable inflationary developments (such as the Jan’23 US CPI reading) could lead to market overreactions in the near term.

- US Treasuries (UST) markets reacted adversely to unfavourable CPI readings; Malaysian Government Securities (MGS) yields remained relatively unchanged. The US yield curve was higher across all tenors as market participants were forced to balance the previously bullish rates outlook with high inflation. US volatility notwithstanding, we note that the MGS market was relatively calm and attention may be more towards upcoming events such as the re-tabling of Budget 2023. Our house view remains for 1 more rate hike of 25bps in Malaysia for the Monetary Policy Committee (MPC) meeting in March before pausing, although this is dependent on inflation and growth outcomes. The rising risk of a slowdown in developed markets would likely cap Malaysian bond yields progressing further into 2023.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.