11 July 2024

Monetary Policy Committee (MPC)

- Bank Negara Malaysia maintained Overnight Policy Rate (OPR) at 3.00%. Bank Negara Malaysia (BNM) stayed the course in July’s Monetary Policy Committee (MPC) meeting, deciding to hold the OPR steady at the 3.00% level. The pause marks the seventh consecutive meeting that the central bank maintains status quo on the policy rates since Jul’23. This decision was widely anticipated by the markets and in line with our view that the OPR will be maintained at the current level throughout 2024.

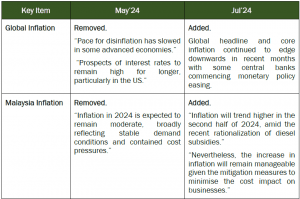

- Neutral tone in the latest Monetary Policy Statement (MPS) from Bank Negara Malaysia (BNM) suggests that the central bank is comfortable with the current monetary policy settings. BNM continues to affirm that the current policy stance remains supportive of the current economic condition, and in line with their assessment of inflation levels and growth prospects. Additionally, BNM acknowledged the positive impact of coordinated efforts by the Government of Malaysia (GOM), Government-Linked Companies (GLCs), Government-Linked Investment Companies (GLICs), and Corporates in mitigating pressure on the ringgit. However, there were two key changes in the latest MPS compared to May’24, relating to the global and domestic inflation, as follows:

- However these changes, in our view, do not alter the overall monetary policy settings in either way for the near term as upside and downside risks to the inflation and growth outlook remain in place.

- Global economy continues to expand amid resilient labor market and recovery in global trade. Looking ahead, global growth is expected to be sustained, as headwinds from tight monetary policy and reduced fiscal support will be cushioned by positive labor market conditions and moderating inflation. Global trade continues to strengthen as the global tech upcycle gains momentum. The MPC remains cautious of the downside risks to growth which includes geopolitical tensions, higher-than-anticipated inflation outturns, and volatility in the global financial markets.

- Malaysia to sustain strong economic activity in 2H2024; driven by resilient domestic expenditure and improvements in external trades. The labor market remained resilient, with the May’24 unemployment rate stable at 3.3%, supported by a high participation rate of 70.3%. While rising costs may moderate discretionary spending, the withdrawal of RM7 billion from Employees Provident Fund (EPF) Account 3 as of Jun’24, and the 13% salary hike for civil servants will continue to support consumer spending. Further, exports in May’24 showed a strong recovery with a 7.3% YoY growth, driven mainly by increased exports of electrical & electronics and palm oil/related agricultural products in line with the tech upcycle. We anticipate that strong domestic consumption, a rebound in external trade, and increased tourist arrivals will act as key catalysts for economic growth. Full year 2024 GDP growth is expected to be in the range of 4.5% – 5.0%.

- Higher inflation trend expected in 2H2024 amid subsidy rationalization; but remains manageable. Headline inflation increased to 2.00% (Apr’24: 1.80%) in May’24 amid the recent rationalisation of diesel subsidies. Despite this, mitigation measures are in place to minimise the cost impact on businesses. The upside risk to inflation will depend on the spillover effects of further domestic policy measures on subsidies (RON95 fuel) and price controls (including rice, sugar, eggs and cooking oil), as well as fluctuations in global commodity prices. For the full year, headline inflation is forecasted to average between 2.0% and 3.5%, while core inflation is expected to average between 2.0% and 3.0%.

Opus View

- We expect BNM to maintain OPR at the current 3.00% rate for the whole of 2024. The recent Monetary Policy Statement (MPS) also implies that the central bank does not intend to tighten monetary policy to address ringgit volatility, remarking that ‘BNM will continue to manage the risk arising from heightened financial market volatility’ and ‘the monetary policy stance remains supportive of the economy and is consistent with the current assessment of inflation and growth prospects’. Additionally, we also expect the US Fed to begin cutting rates in 2H2024, narrowing the yield differentials between US Treasuries (UST) and Malaysian Government Securities (MGS) which will provide some support to the Ringgit and bolster our local bond market.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.