22 April 2024

Federal Open Market Committee (FOMC)

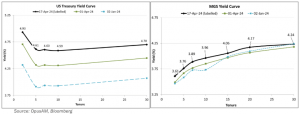

At the time of writing, US Treasury (UST) yields have surged about 70bps on average across all benchmark tenors of the curve since the start of the year. UST 2Y briefly tested the 5.00% level on 16 Apr’24 from the year-to-date low of 4.12% on 12 Jan’24 while UST 10Y surged to 4.67% from the lows of 3.82% seen in 1 Feb’24. In terms of rate cut expectations, markets are now only pricing in 25bps cut for 2024, with the start being pushed to Sep’24, a drastic shift from the initial consensus of 175bps cut.

Reflecting on the past 2 months leading up to this moment, we saw statements of some Fed members emphasizing on “data-dependency” to provide “confidence of disinflation progress” for their rate decisions as a means of giving them more optionality. This contrasts with the dovish-bias in their tone towards policy easing as seen from the drastic pivot in the Dec’23 Federal Open Market Committee (FOMC) meeting.

While Fed Chair Powell initially dismissed the stickier than expected inflation data in January and February as being “seasonal” and guiding almost certainty of cuts in 2024, he took a surprising turn on 16 Apr’24 by reverting to the “holding rates for as long as needed” narrative justified by the recent lack of disinflation progress.

Indeed, recent economic data releases have made it hard for the Fed to confidently start their easing cycle. Case in point, labour market condition as indicated by non-farm payrolls have been stronger than expected for the fifth consecutive month, with 303K jobs added (estimate: 200K) in Mar’24 while also noting there were upward revisions to prior month data. Meanwhile, core inflation rate has been higher around 0.4% month-on-month (MoM) in recent months, derailing the disinflation trend with some notable re-acceleration in the core services component (closely watched by the Fed) in addition to shelter inflation remaining elevated. Further complicating this outlook is the fact that Brent crude price has been resurging to a 3-month high of USD91 per barrel after the direct confrontation between Israel and Iran, risking further conflict escalation in the region that could potentially threaten energy export routes.

Opus View

At this juncture, it is still premature to conclude that a second wave of inflation re-acceleration trend is underway in the coming months which warrants completely pricing out any hikes for 2024 (unless Brent crude oil price is sustained above USD100 per barrel) or to an extreme extent, another rate hike. However, the recent data no longer justifies the case for the Fed to start easing in June or July as previously expected. Notwithstanding any systemic events (e.g. banking crisis, liquidity crunch, asset bubble burst), the Fed will likely keep its optionality in every press statement and delay the first rate cut up to late 3Q’24 or 4Q’24, with the quantum of cuts ranging between 25 – 75bps.

Until then, volatility in bonds could remain elevated, with the largest risk factor being the market repricing for another potential rate hike. Our house view is still for a rate cut for the next move, and we believe that with the market now pricing only 25 bps rate cut, the big repricing adjustment has already taken place.

As for our MGS market, yield movements are relatively muted relative to its US treasury counterpart mainly due to the expectations that BNM will hold Overnight Policy Rate (OPR) at the current rate. Local institutional investors (e.g. Government-Linked Investment Company funds) that are implicitly required to support our local currency through the repatriation of their investment proceeds will continue to support the demand in our MGS market, thus mitigating any severe selloff. As such we remain comfortable with our duration currently at the lower bound of our 4 – 6 years duration target, and any yields movement upwards provide opportunity for lengthening our duration slightly.

Disclaimer

The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity. Individual investors should contact their own licensed financial professional advisor to determine the most appropriate investment options. This material contains the opinions of the manager, based on assumptions or market conditions and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information provided herein may include data or opinion that has been obtained from, or is based on, sources believed to be reliable, but is not guaranteed as to the accuracy or completeness of the information. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. Opus Asset Management Sdn Bhd and its employees accept no liability whatsoever with respect to the use of this material or its contents.